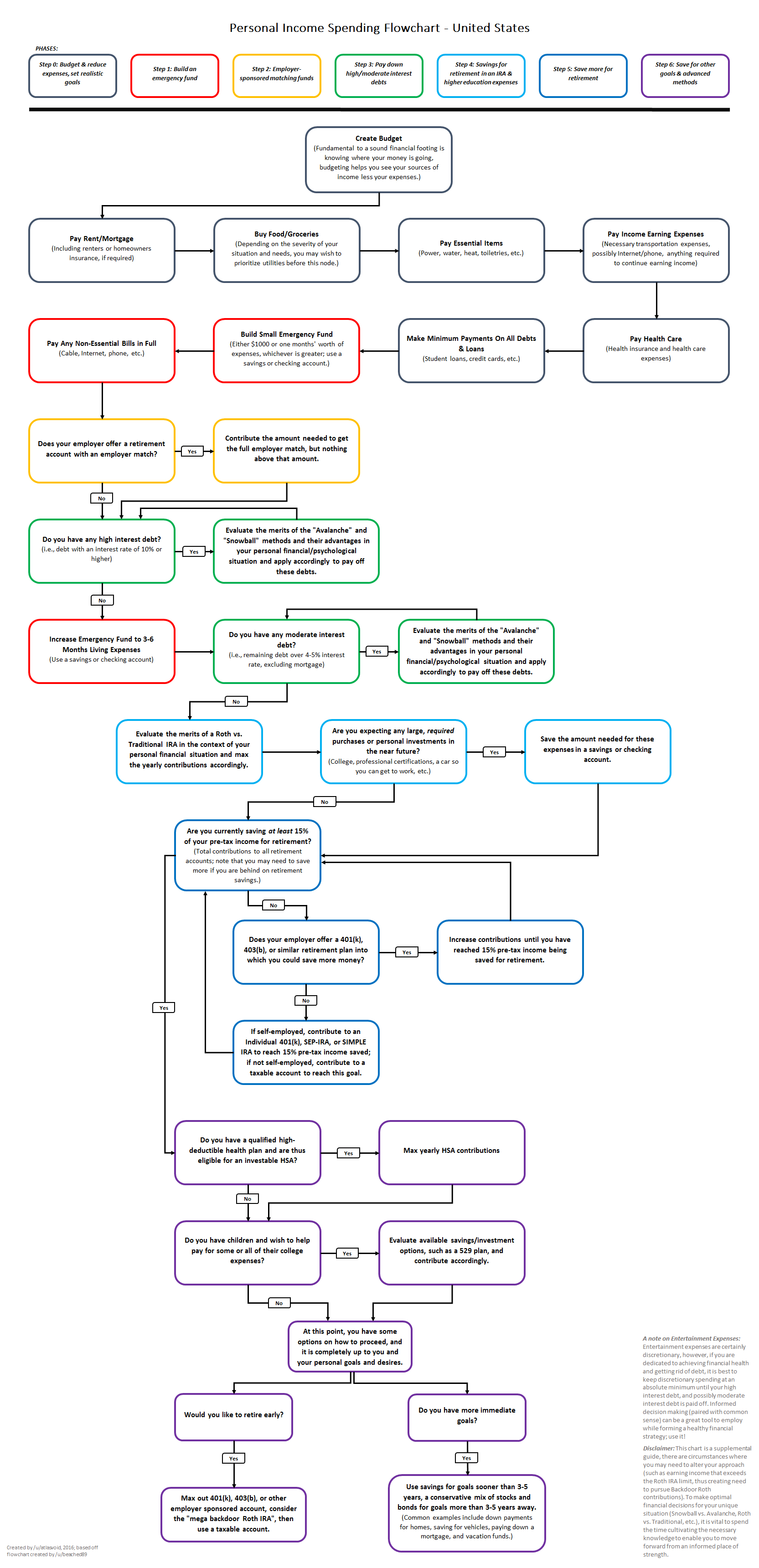

If the company you work for offers a match with their 401k or other retirement plan, do that first! My company offers a dollar-for-dollar match for the first 5% of my salary that I invest. This means that I double my money, making an instant 100% return on top of what I would make in the financial markets. Who doesn’t want free money!?

After that, pay off all your high-interest debt!

Then fund your Individual Retirement Account(IRA).

Disclaimer: There is no one-size-fits-all when it comes to financial advice, but I personally hate when people say “It depends…” and then proceed to give an answer that does not add value. To avoid this, I’ve laid out some general advice that will be helpful to the majority of millennials who’ve recently entered the workforce and want to invest their money.

How 90% of Millennials Should Start Their IRA:

- Go to Fidelity.com.

- Open a Roth IRA.

- Put in at least $10 via bank deposit.

- Purchase your target-year retirement stock (for me that would be FDEEX 2055) or FXAIX, which tracks the top 500 US companies.

- Set up automatic deposits from your bank account so that you max out the $6,000 that you are eligible to put in for the year ($500/month).

Why Save/Invest in an IRA Anyway?

40 years ago, if you had invested just $1,000 in the stock market in a S&P 500 Fund (which tracks the financials for the top 500 companies in America), it would have grown to $23,500!

These days, a savings account from the big banks (PNC, Wells Fargo, BoA, Chase, etc.) will give you .03% interest over the year. So, if you stash $50,000 in your savings, at the end of the year you get $15. Contrast this with keeping your money in the market through an IRA and reap the stock market average return of 7% – that $50,000 makes you $3,500!

Unless you’re a day trader who hopes to make your income off of trading, I recommend investing through an IRA rather than a standard brokerage account. When I first started investing, I opened a regular brokerage account through Scottrade. This was a mistake. I didn’t need the money, I just wanted to invest it so it would grow for the future. So basically I was using taxed money that I again paid taxes on when it would grow…bad idea!

An IRA is a tax-advantaged savings account that allows you to forego one of these taxes. Essentially, you pay half the taxes. That can be quite a big deal. If you don’t need to immediately access the gains on your investments, I definitely recommend investing through an IRA rather than a standard brokerage account. You can pick the same stocks/funds with an IRA as with a standard brokerage account, and you can even use a self-directed IRA to purchase things like rental properties.

What is the Difference Between ROTH and TRADITIONAL IRAs?

The difference between these two types of IRAs is primarily when the money deposited into the accounts gets taxed.

Roth: You put money in after you paid taxes on it. But it is tax-free to withdraw.

Traditional: You put in tax-free money, but pay taxes when you withdraw it.

From a purely mathematical perspective, these two options are the same. Let’s say you are in the 20% tax bracket when you put in your money ($1,000) and when you withdraw your money 5 years later. Let’s also say that the money you put in grew 10% each year. Here’s how it goes:

Roth: $800 -> $880 -> $968 -> $1065 -> $1171 = $1171 (money you withdraw)

Traditional: $1000 -> $1100 -> $1210 -> $1331 -> $1464 = $1171 (money you withdraw after 20% tax hit)

Although it may initially appear that neither option is better, there are several things to consider when deciding which IRA is best:

- Are you going to be richer and in a higher tax bracket (10%, 15%, 25%, 39.6%) when you retire?

- Are you in a high or low tax bracket right now?

- Will you potentially need access to the money prior to retirement?

- Additionally, there are income limits for the Roth, so you may be forced to go Traditional. But there are stricter income limits for the Traditional if your work offers a 401k or other retirement plan. I’ll discuss this later.

So Why is the Roth IRA Better?

The main reason that I think a Roth IRA is better than a traditional IRA is that you can withdraw your contributions penalty-free from your Roth IRA at any point. For a more in-depth look at IRA withdrawal rules, check out this link from vanguard: https://investor.vanguard.com/ira/ira-distribution-rules.

Let’s say you put in $5,000 yesterday, and today you find an incredible real estate property that requires a $5,000 down payment. You can withdraw that money penalty-free.

Tip: Even though withdrawals are penalty-free, you are only able to contribute $6,000 a year. You don’t necessarily want to penalize yourself by withdrawing the $20k which took you 4 years to save. However, the IRS will allow you to return any amount you withdraw as long as you do it within 60 days. Keep in mind that this is considered a roll-over and can only be done once every 12 months.

The other main reason is this: maybe you get taxed on the $6,000 today but 30 years from now, that $6,000 could have grown (assuming 10% annual growth) to $100,000. In the Traditional you would be taxed on all $94,500 you withdraw, but in the Roth – you own that money free and clear! So if you are young and plan to keep maxing out, you can easily have millions saved up by retirement.

Once you reach retirement age, if you picked Traditional, you would have to regulate withdrawals so you don’t get too much “income” and withdraw money in a higher tax bracket. If you went Roth, you could withdraw a million dollars and wouldn’t have to pay a penny of taxes on it.

One of the few reasons why you might want to go against this advice is if you plan to retire early and take advantage of the Roth Conversion Ladder. (If you are planning to retire early, you are probably financially savvy enough to heed your own advice.)

Some other reasons Roth is better:

- You are limited to only putting $6,000/year into an IRA, but $6,000 a year after taxes is like condensed money and worth a lot more than before-tax dollars. So you are effectively able to contribute more.

- If your work offers you a retirement plan (401k/403b), you are restricted from contributing to a Traditional IRA if your Modified Adjusted Gross Income is over $62k (single)/$99k (married), as opposed to Roth IRA limitations starting at $118k (single)/$186k (married).

- A dedicated FamVestor reader, you will likely be making more money and be in a higher tax bracket in the future.

Should I Save Enough for an Emergency Fund First?

I hear many excuses for why people have not started their IRA yet. Many financial advisors suggest that people have an emergency fund before making investments. But, because of the flexibility of the Roth IRA, I recommend (contrary to most advisers) that people use their Roth IRA as an emergency fund. I think it’s prudent to keep some money ($1k-$3k) in your savings, but I don’t agree that you need to stash away 6 months of expenses in a savings account before even considering depositing money into an IRA.

Rather than sticking your money in a .03% return savings account, you have some real potential to get a good (>7%) return that will help you save toward retirement. And, if you do ever need those funds in an emergency, you will be able to pull out all your contributions exactly as if the money were in a savings account, albeit with maybe a week’s transaction delay.

It’s a win-win. You have access to the funds if you ever need them, and they gain interest in the meantime. It’s actually more likely that these funds will remain untouched, since you probably won’t check the balance as frequently as you might for a savings account.

The caveat here and the reason most financial planners do not recommend this strategy is the element of risk it adds. What happens if the market crashes and you need that money?

Example: You put in $6,000 and the markets drop 30%, so now you only have $4,200 in the Roth IRA, but you get into a car accident and you need those funds right away. Because it’s an emergency and you cannot wait for the money to grow back to $6,000+, you effectively lose 30% of that money and you only have the $4,200 to use toward your emergency.

My recommendation: take a look at the historic average, notice your own tendencies and your risk tolerance – then decide if this strategy is right for you.

So start auto-depositing to max out your Roth IRA today! It will take $500/month to max it out if you start in January. Set it and forget it. If you do ever need it, you have no worries, because you can always pull that money back if necessary. So what do you have to lose? Start right now! There are no excuses!

Case Study: My Personal Investing Story

I opened a Scottrade brokerage account and bought my first stock in 2011. I started getting the $25k Smart Scholarship stipend at that time and thought it would be good to start learning about investing. After no research, on 10/20/2011 I bought 10 shares of Toyota just because I liked the company. Most of my investing in the beginning was like this, just picking companies because I personally liked their services.

Four days after buying that first Toyota stock I saw Netflix stock dip and proceeded to buy 5 shares at $118.25/share. The very next day the shares tanked and were only worth $77.50. Instead of panicking and selling all my stock, I decided to double down and use dollar cost averaging to hopefully save on some of my losses, so I bought 5 more. Four years later the stock split 7:1 and is now selling at $145.17 a share, that’s $1,016/Share before the split – it has gone up 938% since I bought it.

So that was awesome, right? But what about my other stock picks, like Groupon and Ebay, which both tanked for me…? Yes, I picked some winners, but I also picked a lot of losers. I tell you this story so you don’t go into investing without a clue, like I did. Very rarely do I buy individual companies now, and if I do, I consider it almost like using play money.

Now all my serious investments go into low-cost index funds (ex. VFINX Vanguard’s S&P 500 Index Fund). This is advised because your success is no longer determined by the outcome of one or just a few companies. These index funds are comprised of hundreds of companies. They have lower costs since they are typically passively managed, are lower risk since they are diversified through multiple companies in a single fund, and are more tax efficient due to there being fewer trades than an actively managed fund.

I consider myself a very passive investor. I look at my portfolio maybe once a week, and very rarely do I sell anything. Right now, I have automatic distributions from my bank account into my Roth IRA, mostly putting money into a Vanguard Admiral Fund. I set the automatic distribution to max out my wife’s IRA and my own IRA for the year, $11,000 between the both of us.

For those who still have a lot of high-interest debt, I recommend reading my budgeting post, and also to look at the flowchart below. If you have the extra income, definitely start investing – start with the seven steps outlined at the beginning of this post. Do this and your future self will thank you. I wish you all the best of luck, and Godspeed!