This is the story of how we – a family of four on one income – house-hacked our way from $0 to $1 million in real estate holdings in less than 2 years, and how just two houses bring in $100k/year in gross rental income.

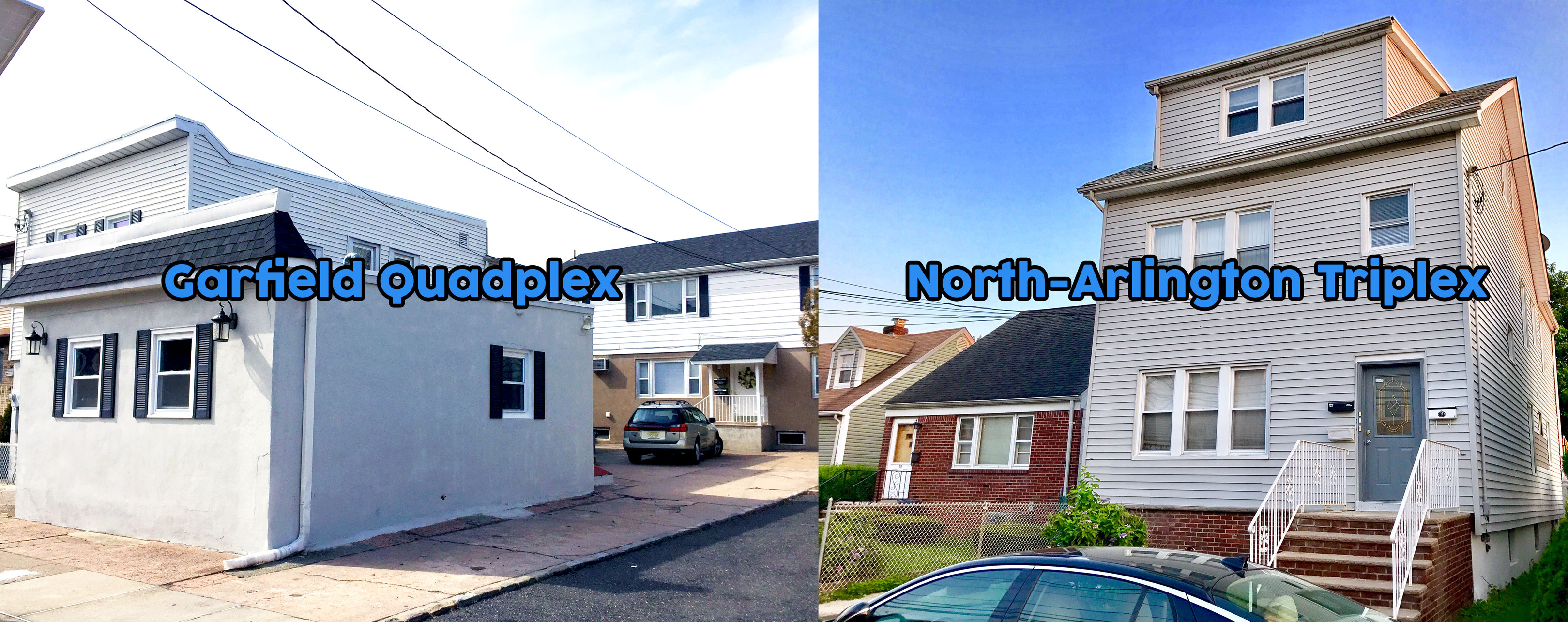

Today we closed on our second investment rental property, a 3-family home in North-Arlington, NJ (15 minutes from NYC). We bought it for $350,000 and it appraised for $370,000 (low in my opinion).

Our first home and first-ever real estate purchase was a 4-family home in Garfield, NJ, also 15 minutes from NYC. We bought it in October, 2015 for $430,000; last month it appraised for $630,000.

Together with the two properties, we own $1,000,000 in real estate, which is pretty cool, especially considering that we didn’t own a single piece of property just two years ago. When I say we, it is me and my wife. We are a team.

So the million dollar figure is really cool, but what is really awesome is the cash flow from the rentals.

We have a total of 7 units; four 3-bedroom units in Garfield, and two 2-bedrooms and one 1-bedroom in North Arlington.

The $8,350/Month Club

I recently made it a goal for myself to join the $8,350 a month club…that equates to $100,000 annually.

Currently, we live in one of the units in Garfield, and my in-laws live in another. Here is how the rents break down:

Unit 1 (3 bdrm): $0/month

Unit 2 (3 bdrm): $1,000/month

Unit 3 (3 bdrm): $1,710/month

Unit 4 (3 bdrm): $1,700/month

Total: $4,410/month

In North Arlington, the third unit is currently vacant, and the other two units are paying $1,200/month, which is far below market rate. Below is my plan for renting out the units for once their leases expire:

Unit 1 (2 bdrm): $1,500/month

Unit 2 (2 bdrm): $1,500/month

Unit 3 (1 bdrm): $1,200/month

Total: $4,200/month

So together that’s $8,610/month in gross rent, well past my goal. With just these two properties, we should be able to get over $100,000 in passive rental income; keep in mind that includes us living in one of the units for FREE!

Of course, there are major expenses to consider, things like mortgages, home insurance, property taxes, vacancy considerations, and maintenance costs.

Property Expenses

Garfield (Quadplex) Annual Expenses:

Mortgage: 3.49%, $24,216 ($2,018/month)

Property-Taxes: $11,181

Insurance: $1,581

Utilities: $3,000

Vacancy + Maintenance: $3,500 (estimate)

Total Expenses: $43,478

North Arlington (Triplex) Annual Expenses:

Mortgage: 3.875%, $15,792 ($1,316/month)

Property Taxes: $13,672

Insurance: $1,112

Utilities: $2,000

Vacancy+Maintenance: $3,000 (estimate)

Total Expenses: $35,576

Total Yearly Expenses for Both Properties: $79,054

How We Can Retire With Just These Two Properties

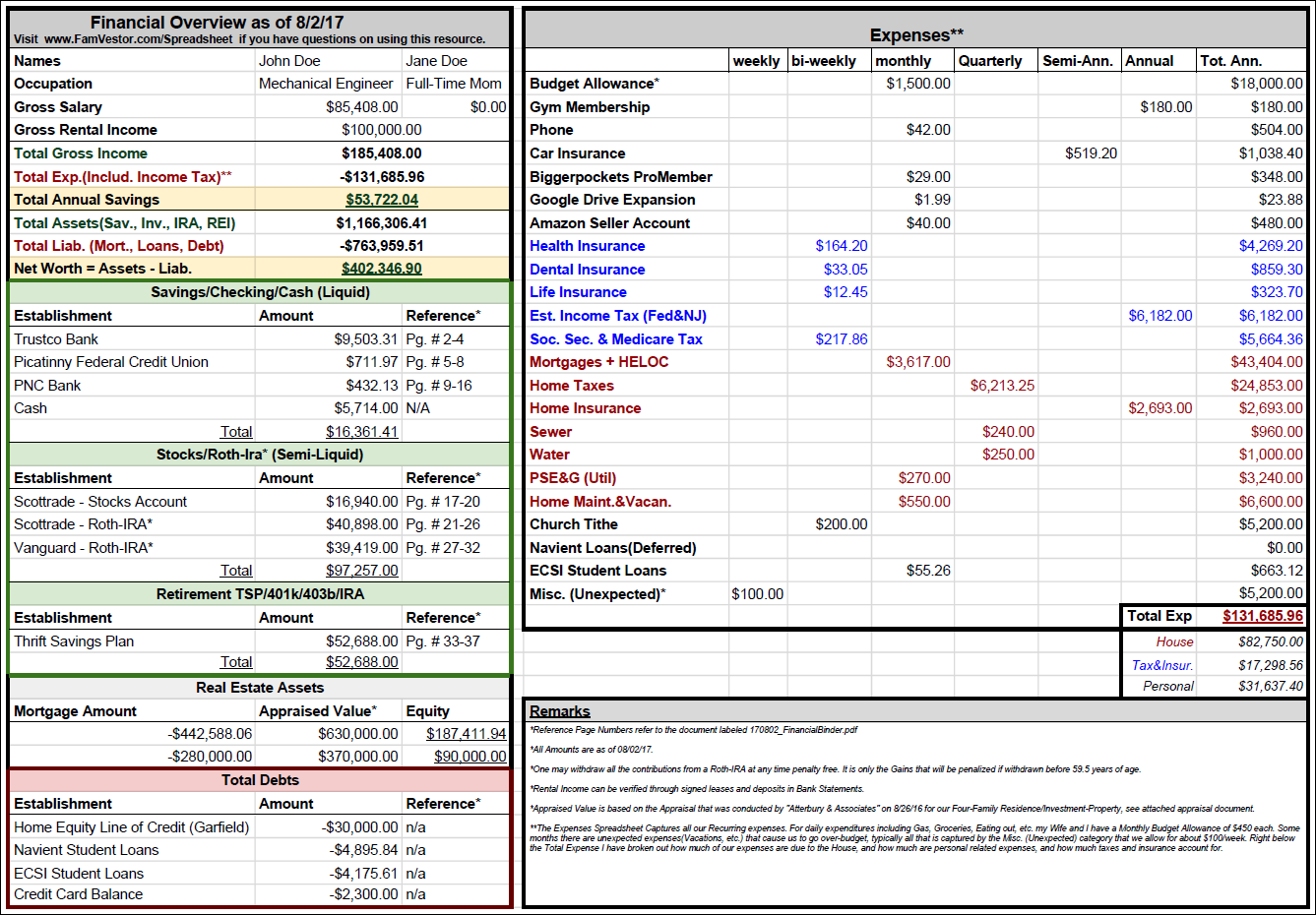

Subtract the total expenses from the $100,000 and you are looking at $20,946/year or $1,745/month; it’s not super extravagant, but a decent sum of money and we still get to live in one of the units for free!

But what if we paid down the mortgage? The total expenses minus the mortgage equals $37,446; subtract that from the $100,000 and you get $60,954/year, or $5,080/month. That amount, combined with our frugal lifestyle, means that we could actually live off the income, especially considering that our housing costs are covered by living in one of the units.

Our Entire Real Estate Journey and How We Did It In 40 Minutes.

Ambition or a Simple Life?

Now the dilemma: do we strive for more and keep buying properties, expanding our income but also our expenses and making our life a little more complicated, but perhaps greater? Or, do we want to just live simply by keeping our income the same and just lowering our expenses. Once that mortgage payment is gone, we are in essence financially independent.

Early Retirement Through Real Estate Alone

Using my Financial-Spreadsheet I calculated – assuming the $100,000 in rent – that our annual savings rate after all expenses is $53,722. After maxing out my 401k ($18k) and our IRAs (2 x $5.5k), that still leaves $24,722 in excess to put towards our mortgage. I would focus on paying down the smaller one first, $280,000 (the North Arlington triplex), and that would take 7.75 years. Once that is paid off, I would continue to contribute the same amount plus the $1,316 I was paying toward the North Arlington triplex mortgage to the Garfield quadplex mortgage and could pay that down in 6.5 years. So, in total it would take 14.25 years to own the houses outright and receive, after expenses, passive income checks from the rental properties of $5,080/month.

Dilemma

After considering this dilemma for a while, I have resolved to take the simpler, frugal approach.

While attractive, it is not my dream to build a real estate empire. When I first heard the Biggerpockets podcast and got inspired about real estate investing, it wasn’t the stories of the millions that inspired me. Rather, it is those individuals who are able to run their own lives, no longer slaves to a paycheck, who are inspirational – they are masters of their own time.

I am 27 years old, with a wife and two kids and plans for two more. I like my federal government job as a R&D prototyping engineer for the Department of Defense. But what I like more is freedom. We’ve already gained partial freedom by purchasing that first quadplex, which gave my wife the financial freedom to quit her job as a school teacher to stay home with our kids.

I guess my chance at freedom will come in 14 years. When I am 41.

If my Amazon Business or Blog takes off, this amount of time could be substantially reduced. I still have my reach goal of early retirement set at the age of 28. My wife was 28 when she retired from teaching.

How Did We Do It? FRUGALITY!

So, if you’ve made it this far, you’re probably thinking, “good for you.” How were you even able to afford these properties, especially with two kids and only one (government) salary?

The answer is quite simple: frugality!

When we got married in 2013, my wife started her career as a teacher making $50k, and I started my career as an engineer at $53k. So we were bringing in over $100k/year!

Pretty good money, and because we both were raised in frugal households, we saved it!

Our Frugal Strategies

- We lived at with my parents, paying them $500/month

- We packed our own lunches for work

- We lived off a cash-budget of $450/month in out-of-pocket expenses

- We cut our own hair

- We rarely went out to eat

- We re-sold unwanted things

- Don’t pay for cable TV or even own a TV

- We don’t drink alcohol or coffee

- We bought everything used from eBay, Craigslist, or at garage sales

- Travel for free/cheap via Travel-Hacking, and don’t fall for tourist traps

- Pay less than $20/month each for our cell phone service (T-mobile Unlimited Family Plan for 8 people)

- We bought reliable used cars – a Honda Fit ($3,000) for my wife, a Toyota Yaris ($5,000) for me

- We didn’t collect massive amounts of student debt, won scholarships, and worked our way through college, even while taking 23-credit semesters

By the time 2015 arrived, we had over $100,000 saved and we were ready with a down payment, plus money for renovations.

BRRR and Finances of the Purchases

For that first quadplex in Garfield, which we bought in October of 2015, we got a conventional mortgage with 10% down with no PMI. The purchase price was $430,000, so we needed a $43,000 down payment.

Over a period of about 6 months, we put another $25,000 into it.

We then filed for a cash-out refinance, and the property appraised at $550,000, a $120,000 increase from when we bought it a half year earlier! We pulled out $67,000 of that equity in cold, hard cash, pretty much dollar-for-dollar returning all our investment money.

We then invested another $15,000 of work, really beautifying the unit we would be living in.

Then we decided to apply for a Home Equity Line of Credit (HELOC) on the property, and this time, about a year after we bought it, it appraised for $630,000 – $200,000 over what we bought it for!

We got approved for line of credit of $61,500.

So just to be clear, we already took out $67,000 in cash, and now also had available to us $63,000 in a line of credit, at a low 2.49% interest rate.

It was at that point that we seriously began searching for Property Number 2!

As you can see, we didn’t need to save again for that second property because the first property we purchased funded that deal.

It’s really a simple formula called BRRR. I believe Brandon Turner coined that one: Buy, Renovate, Refinance, Repeat!

And that’s exactly what we are doing with this second property.

Formula for Success

So there you have it, our formula for success. It’s not rocket science, but it does take a tremendous amount of discipline.

But, as you can see, in just shy of two years we were able to acquire $1 million dollars in real estate! $630,000 appraised Garfield quadplex, and $370,000 appraised North Arlington triplex.

We had every reason to play it safe. By the time we bought that first property we already had a 6-month-old son, and my wife was on an extended maternity leave. So just one income! She never went back to work and we now have another son, and we are still able to keep doing this!

Plan smart, keep learning, persist, live below your means, and know that you can do this!

Special Thanks

I just wanted to give a big thank you to Biggerpockets. My life would have been a very different story if I hadn’t stumbled on the podcast all those years ago.

I write this story hopefully a means to inspire others toward freedom.

If you liked this story and want to hear in even more detail about all our entrepreneurial ventures that weren’t covered here, check out my Before The Millions Podcast interview. I promise you won’t be disappointed.

10 thoughts on “Sunny Burns and the Quest for a Frugal, Fantastic, Financially Independent Future”

What an inspiring story SK. A story of discipline, sacrifice and success. You’ve developed a high comfort level towards risk. That’ll take you places. You’ve already been thinking about whether you want to pay off your investments and coast or keep going to “build an empire”

That’s good. Just be open to whatever passion God puts in your heart and follow it. Remember God thinks BIG. He’s got plans for our lives. I’ve always tried to stay out of His way Haha.

Thanks Uncle Dave, sounds like good advice.

This is quite amazing…..God bless!

Thanks!

Amazing!

Just attended a BP event hosted by Darren Sager in Manhattan last night and seeing folks complain about the market and you buying a 3-Plex is simply beautiful.

Congrats!

Yep we’ve gone to those. Yea the market is definitely rough, investors bidding up properties everywhere. Just got to get creative, that’s why I started searching on craigslist, and was about to start knocking on doors mailing owners, but then I stumbled on this FSBO.

Hi Sunny,

Great information, full of details. Do appreciate it! Question, what internet service do you personally use? I’m looking at options. Also, do you have cable, if not, what would you recommend?

Hey Brad, my In-Laws upstairs in Unit 2 have Fios, and I pay them $30/month to use that. Cable? Meaning tv? We don’t own a tv, but occasionally we will watch something off our laptop after the kids fall asleep, and we just watch Netflix, off my Dad’s account.

Am impressed, heard your podcast through ChooseFI

You probably know this, but just to be sure:

If you have your rental re-appraised and value has increased significantly, the risk to the bank is lower as it’s worth more.

The % risk therefore falls in a lower bucket in their standard fee structure, the bank charges smaller risk cost, so higher discount on a mortgage.

This sounds small % change, but adds up over time…

Thanks for the advice Tammo, yea I’ve been thinkign to get our Garfield property reappraised, just waiting for some higher comps in the market to come up first. Not too many 4-fams selling.