Do you want to invest in real estate, but wish someone could show you the ropes first?

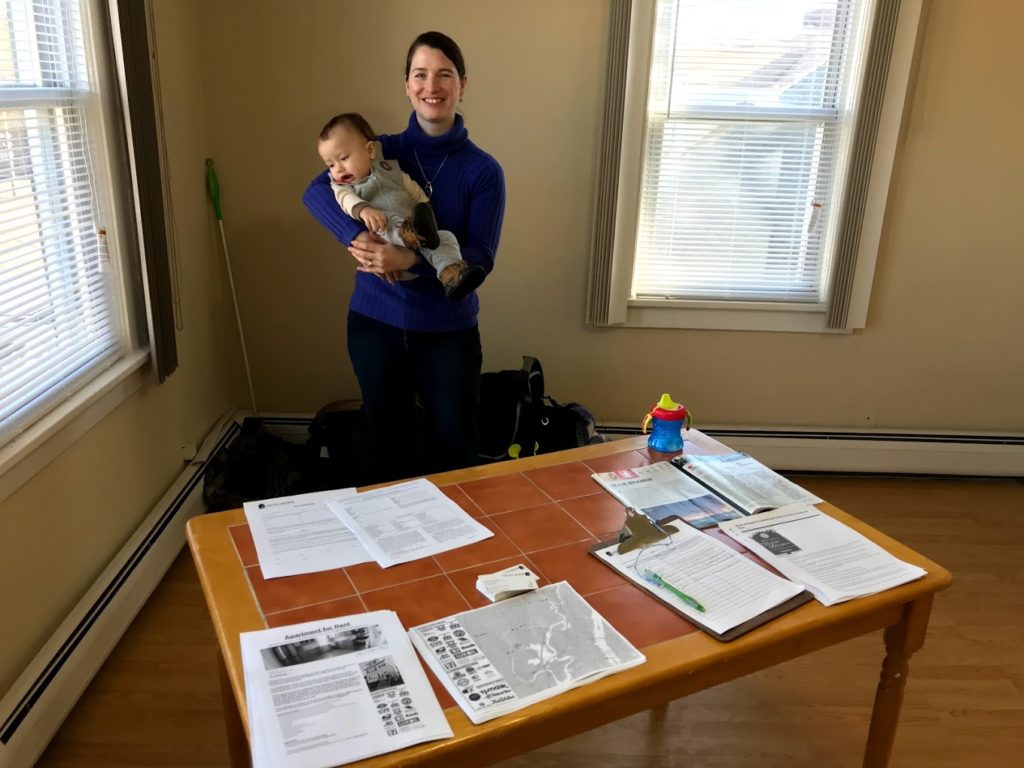

I decided to put together a post going through step by step the process of buying our next real estate investment property, this post will have a lot of updates and will basically serve as a chronicle of how we hopefully get this deal done.

Phase 1 – Searching & Analyzing

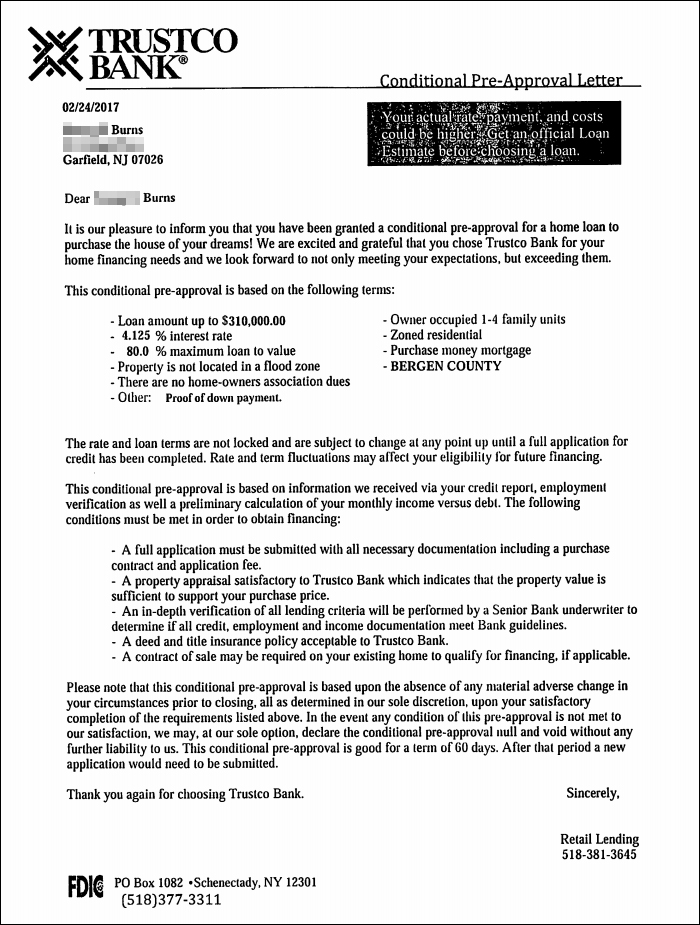

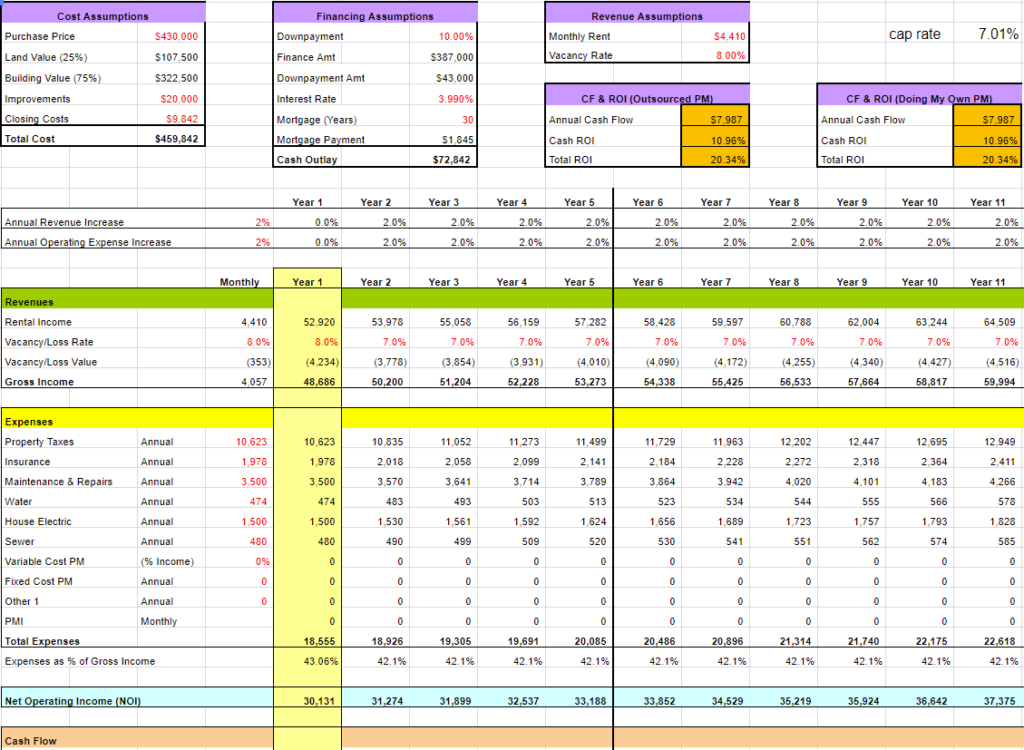

Currently, we are pre-approved for a residential multifamily home for a loan amount of $310,000.

It is low because we already own a $630,000 quadplex(Purchased for $430k just 1.5-years ago) and even though it pays for itself, a lot of banks won’t consider the rental income until it appears on two years of tax returns. My Wife is a stay-at-home Mom so we essentially have only one income, but we are using the same portfolio lender that we used the first time – Trustco Bank. Trustco Bank is considering 75% of our gross rents($4310/month) as income.

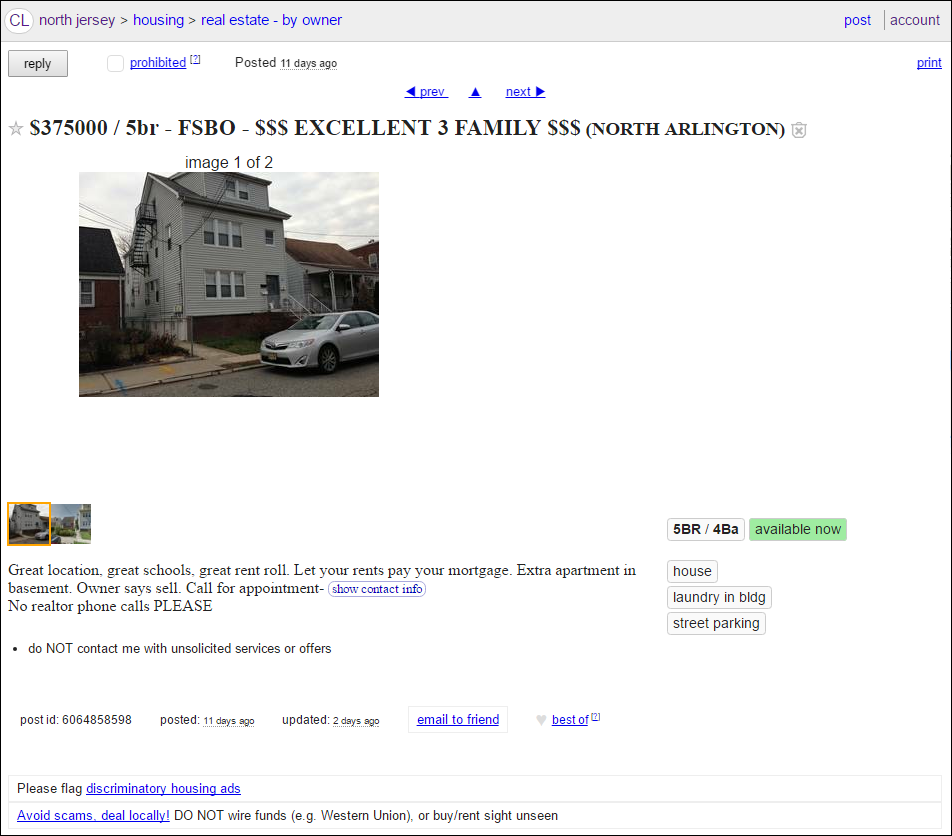

4/7/17 (Day 0) – Found the Property Listing & Analysis

I get an automated email from IFTTT.com every time a post in the North Jersey Craigslist under the Real Estate for sale by owner section has the word “Family”. So this came up and I called:

The owner picked up the phone – very nice guy – and I proceeded to ask him a series of questions:

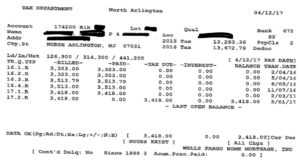

- What are taxes? $13,000 a year

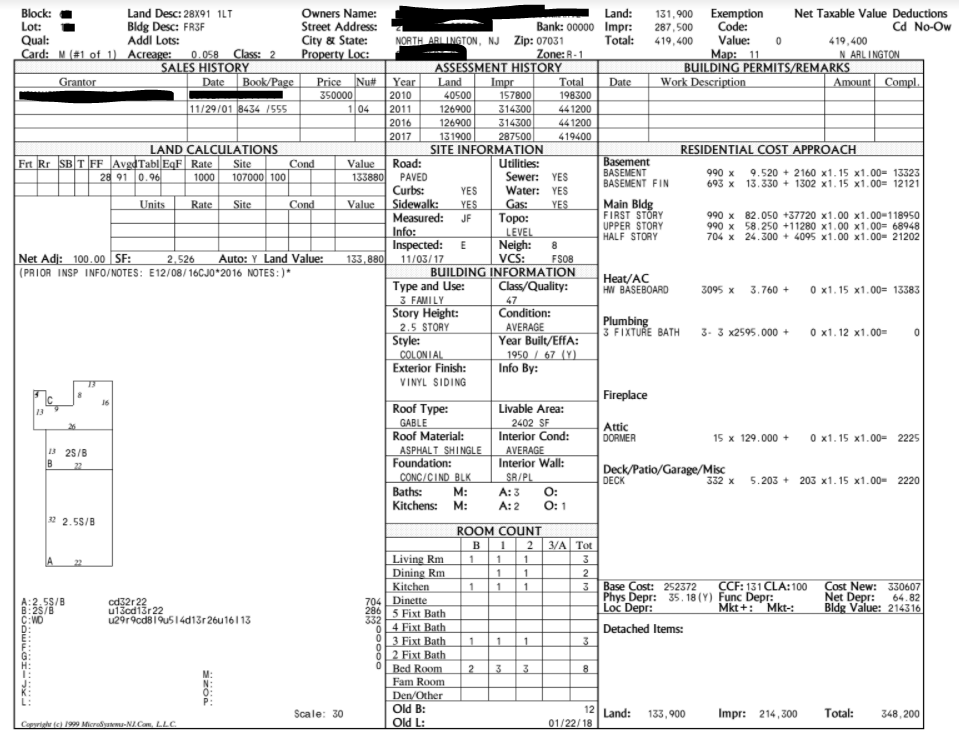

- Is it a legal 3-family? Yes, although I did have a 4th renter, a friend in the finished basement, but the town caught wind and had him kicked out.

- Is it vacant or occupied? 2 units occupied, 3rd one vacant

- Are utilities separated? Yes 3 hot water heaters, and 3 hot water boilers, with a house electric meter

- Tenants on lease or Month to Month? 1 on lease, another month to month

- What is the set-up? 1st floor: 2bdrm/1bath, 2nd floor: 2bdrm/1bath, 3rd floor: 1bdrm/1bath

- Rent amounts? $1200, $1200, and I was going to ask $900. They pay their own utilities.

- Is there parking? Only street parking, but it’s not an issue

- Why are you looking to sell? I’ve owned it 30 years and it served me well but just want to retire from being a landlord.

- Why aren’t you using a realtor? I don’t want to have to pay the commission, I feel I can sell it myself and could use that $17,000 commission cost for renovations at my current house.

- I think I called this house a couple months ago but it was under contract or something? Yes it was on the market, but the buyer’s financing fell through.

- Can I come see the property tonight? Daughter has a softball game, how about tomorrow at 6pm? Sure.

- Have you heard of the Biggerpockets Real Estate Investing Podcast? No. Well me and my wife were on it, I’ll send you a link so you can listen if you want to know more about us.

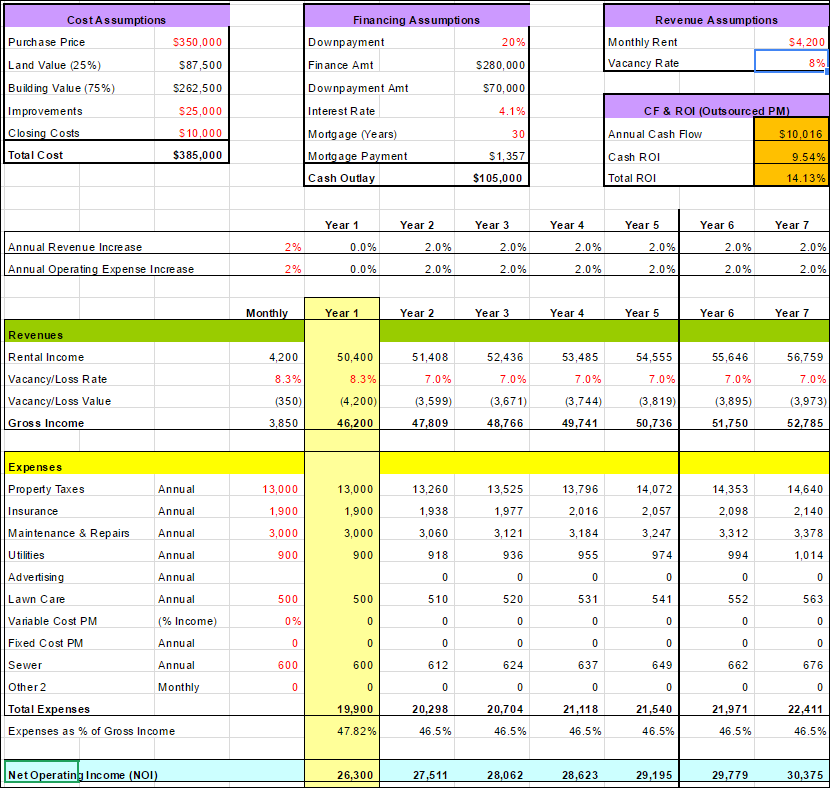

With the information, and after checking craigslist, hotpads and rentometer for what market rents should be, I proceeded to run an analysis on the property with market rents.

The numbers looked good, and I was very excited.

4/8/17 (Day 1) Went to see the Property and made an Offer

We went to go see the property and honestly loved it. Everything in fairly good condition, just severely outdated. A block away from a bus station, that takes you into the city in 40 minutes. Exterior of house in nice shape. Nice porch and small backyard. The bones of the house were very good, just could use a lot of cosmetic updates.

*To see a video(26-min) on how I check out properties, check this video out.*

One immediate area we felt we could add value was the laundry. There was a common access portion of the basement with one dryer and one washer. But currently only the first floor unit was allowed to use it since it was on their gas and electric line. It would be easy enough to put it on the house electric line and put in a coin-op electric dryer and washer and have all the tenants be able to use it.

Anyway we really liked the house! So I show him my pre-approval letter and I tell him, I need to talk to my wife.

We talk.

We decided to offer $25k lower than his asking price – because as I said in my car flipping post: Always, always negotiate!(even if it’s a killer deal already)

So I go up to him, we chat a bit and then I say “We like it a lot, and would like to offer $350,000 for it. We can leave you a $1,000 deposit right now, just so you know we are serious. ” he hesitated a second, and I knew he was uneasy since his last deal fell through, so I said, “I can even leave you a $2000 deposit”. And at that we shook hand, no counter-negotiation or anything.

I told him that he should listen to our podcast on BiggerPockets and he would have a lot more confidence in us. He said he definitely will now, he’ll listen to it with his wife. I told him our lawyer would be in touch with a sales contract.

Three hours later. I received this email from him:

Congrats to you and your lovely wife!

I watched the podcast. Good stuff!Real estate is a great way to attain wealth.My lawyers name is Lisa ——- and she is out of Newark. I will get you her email address tomorrow.She is away on vacation next week but we will get the ball rolling anyway.Good nightBr—– ——-

4/9/17 (Day 2) – Made Formal Offer

Started discussing the deal with my Lawyer, he is drafting the letter of intent and needs to know the following:

- Total purchase price and deposit amount

- Mortgage amount and type of loan, if any

- Property address

- Number of existing tenants and whether you’re taking on those tenants. Basic terms of the lease

- Anticipated closing date

So I responded with:

- $350,000 and we left a $2,000 deposit with the owner(A check that he does not plan to cash)

- Conventional financing putting 20% down, so $70,000 down, with a $280,000 mortgage.

- — —— —–, North Arlington, NJ 07031

- 3rd floor(1 bdrm/1bath) is vacant and to be left vacant. 1st floor(2bdrm/1bath) is month to month ($1200/month) pay own gas/electric. 2nd floor(2bdrm/1bath) is on an annual lease which started two months ago ($1200/month) pays own gas/electric. Owner has one months rent as security deposit which he will transfer over. [Due to the terms of our financing we have to owner-occupy the property, we would Ideally like to move into Unit#1, but don’t necessarily want to put it on the current owner to kick them out. We can take care of that… we think.]

- We would like to close relatively quickly, want to say 5/22/17.

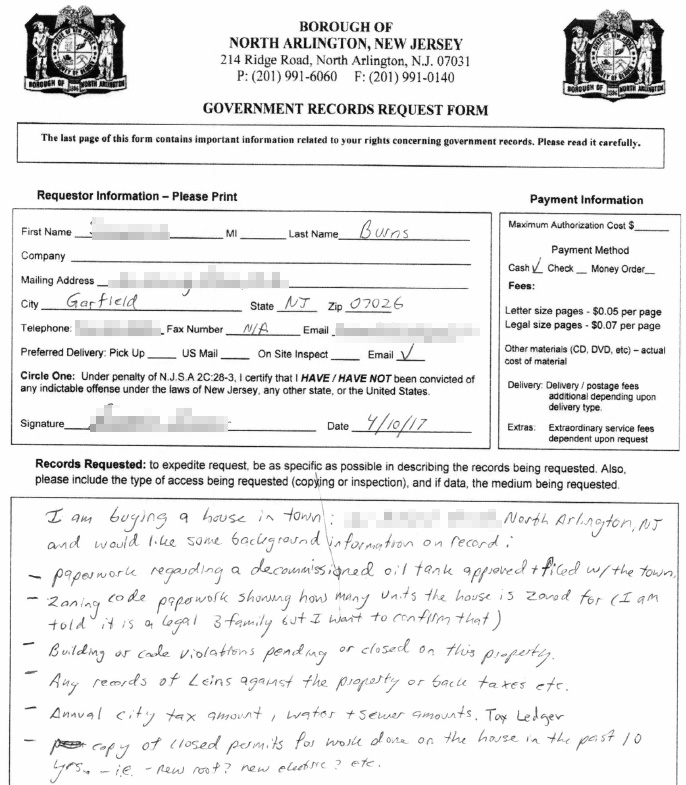

4/10/17(Day 3) – Researching Public Records

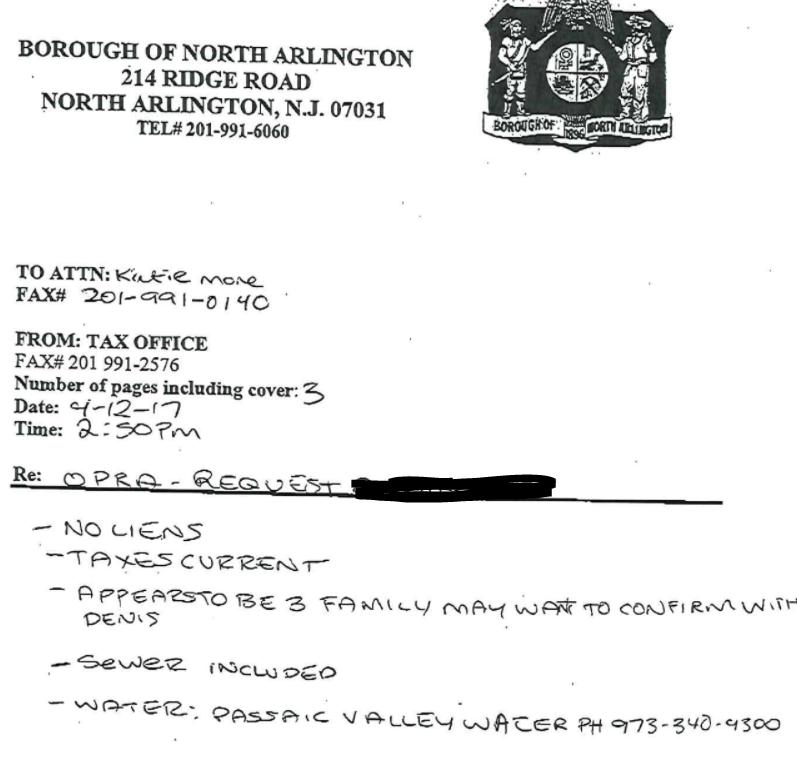

Sunmarie is going to submit an OPRA(Open Public Records Act) request with North Arlington town hall. It basically will show details about the property, taxes, permits that were taken out, things like that. The owner did forward over a certificate for a decommissioned oil tank that was filed with the town.

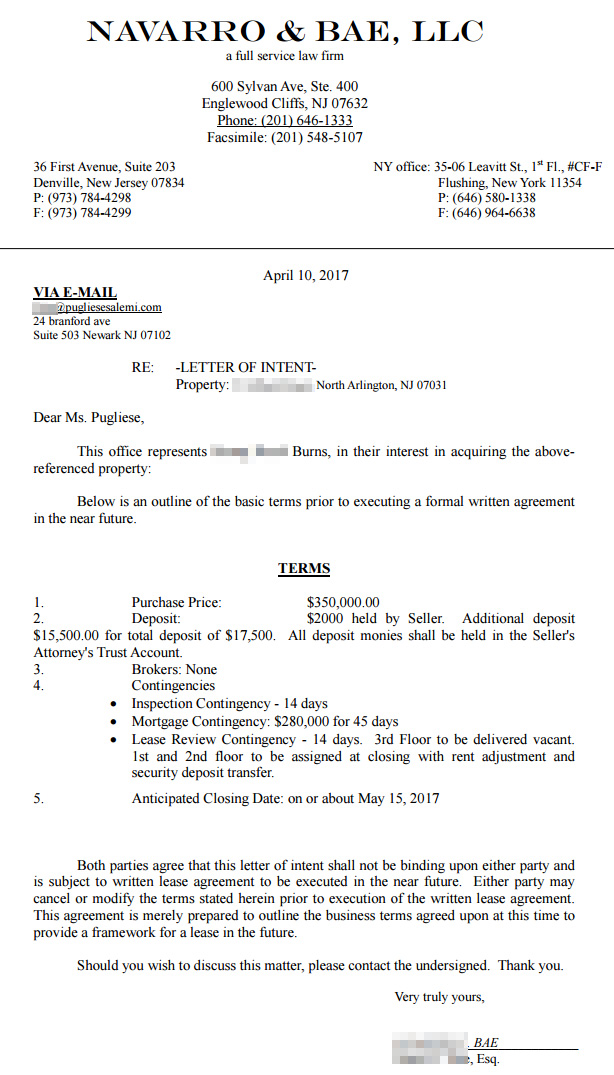

Later on in the day I did receive the draft of the Letter of Intent to purchase that my Lawyer drafted up.

And now we are just waiting on the Owner’s Lawyer to draft a Contract of Sale for us to sign.

4/11/17(Day 4) – Waiting…

So the Seller’s Lawyer is on vacation so we have to wait till Monday. Here’s the email from the Owner:

L—- is in Disney this week. As usual my timing is impeccable. I will get back to you as soon as she gets back to me. Talk to you soon..

4/12/17 (Day 5) – Returned OPRA Request

4/17/17 (Day 10) – Contracts Written Up

Finally some movement! Lawyer is back and drafted up a contract which the seller signed and sent to my lawyer.

In the past couple days me and the owner have been getting to know each other better, talking about podcasts he has just begun to discover after I introduced them to him.

4/21/17 (Day 14) – Under Contract

All contracts and riders have been signed.

4/27/17 (Day 20) – Scheduled Home Inspection

Owner has given our $2000 deposit to Lawyer to deposit into trust account. We scheduled a home inspection based off a friend and landlords recommendation for tomorrow.

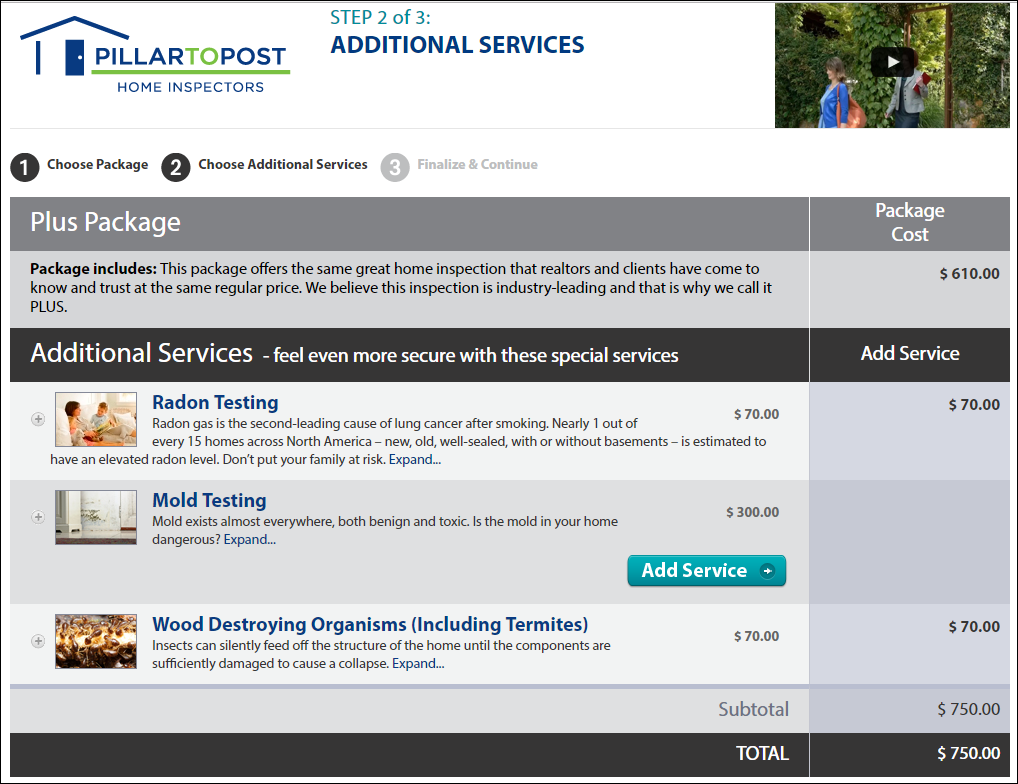

4/28/17 (Day 21) – Home Inspection

Had the inspection with Jim Cook of Bergen Counties Pillar to Post Home Inspections. He was very thorough and meticulously. A little slow, but I actually appreciated that since he took the time to explain exactly what he was looking for and what he saw. I would recommend him and will be using him again. Below is a video(Coming soon) for anyone that is interested:

5/5/17 (Day 28) – Home Inspection Report

So we got the Home Inspection Report Back a few days after the inspection NorthArlingtonTriplex_HomeInspectionReport, no real surprises there.

I forwarded a copy of the letter to my lawyer and he drafted up this letter to the seller’s lawyer, Original_LawyerLetterInspectionRepairs. We decided after looking at the draft that there was way too many things on there, and since the seller wanted the sale as-is, that it would just annoy him.

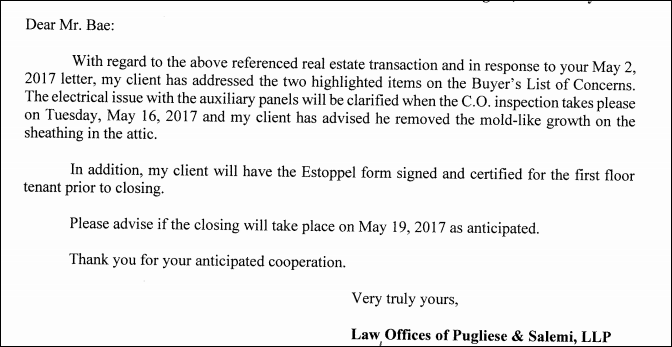

So we decided to narrow it down to just a few key things:

- Outdated Fuse Boxes were concerning us

- Mold-like Growth in attic

5/12/17 (Day 35) – Response to Home Inspection Report from Seller

Received a response back about the concerns.

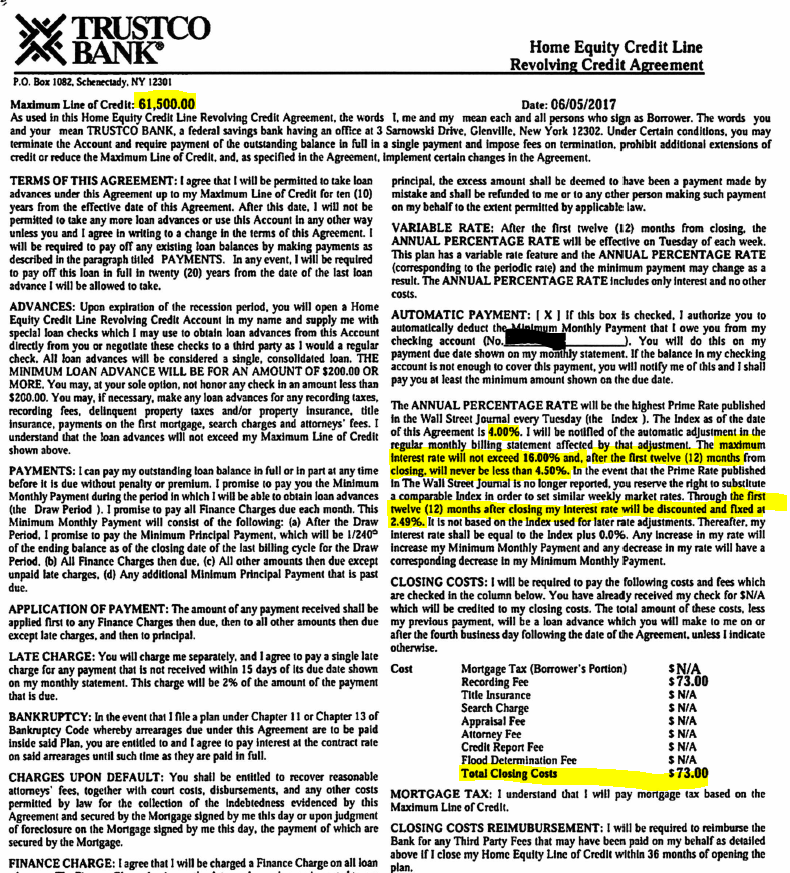

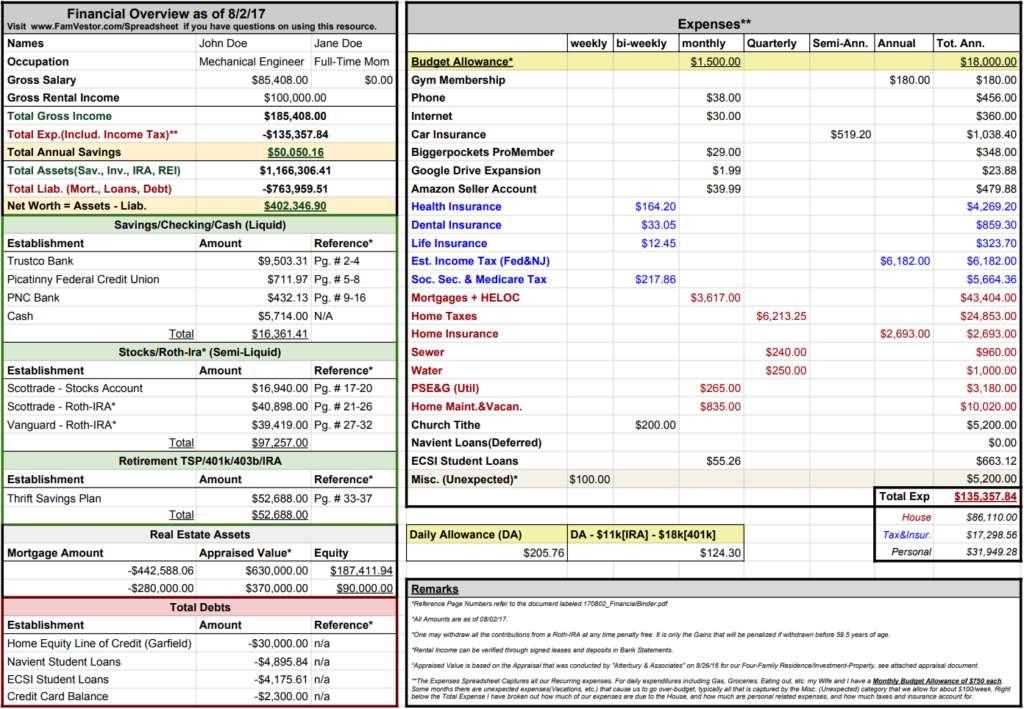

6/5/17 (Day 60) – [Not Directly Related] Closed a HELOC on our first Investment Property

We finally closed on our HELOC(Home Equity Line of Credit) yesterday! I finally got fed up with waiting for the bank, so I called and apparently they had been delaying for weeks because they weren’t able to get in touch with our home insurance to get an updated Policy… I called and in under 5 minutes had the updated policy emailed to Trustco. Very Frustrating…

Anyway we signed, and can now continue forward with the mortgage process for this new home. The HELOC was delaying us, because you can only get it on your primary residence, and since we are owner-occupying this new home we had to close on the HELOC before proceeding with the new primary mortgage on this new triplex.

As can be seen below, we can now borrow against $61,500 to do with whatever we want, including helping to put the down payment on this new triplex! WIN! This also means that the Garfield Quadplex appraised for $630,000, a full $200,000 more than what we bought it for less than 2-years ago. WIN-WIN!

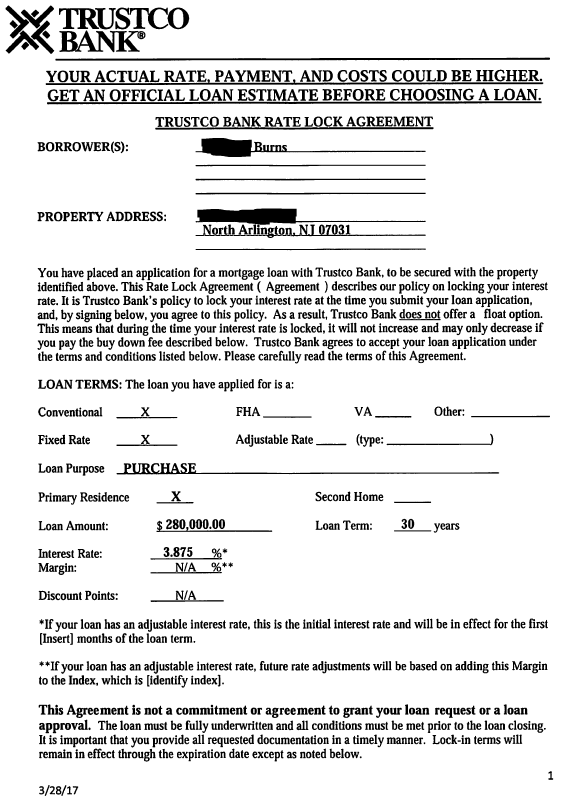

6/9/17 (Day 64) – Started Mortgage Application

Finally was able to officially start the mortgage application for this property. Again through Trustco Bank.

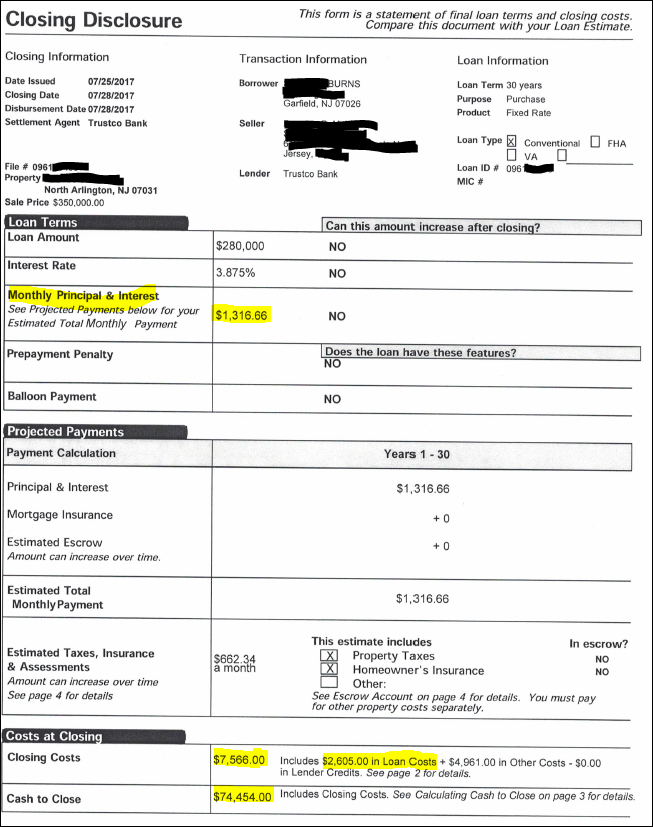

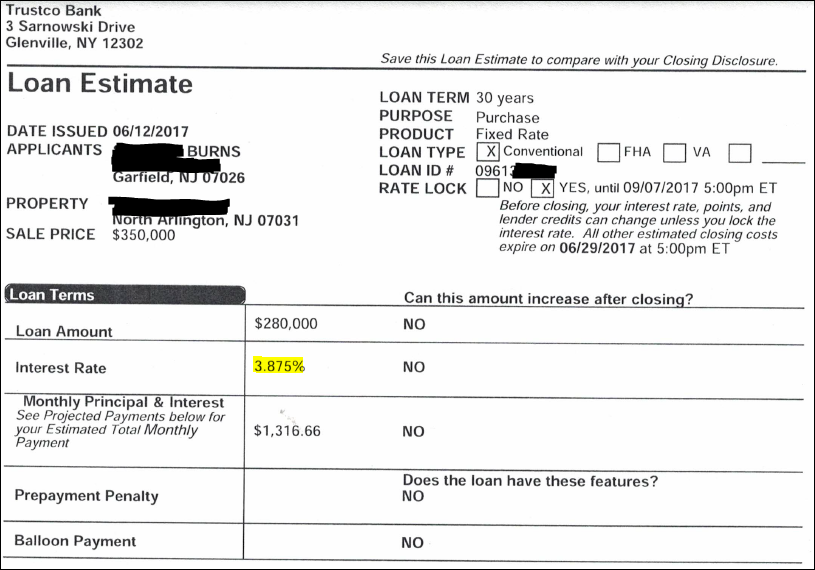

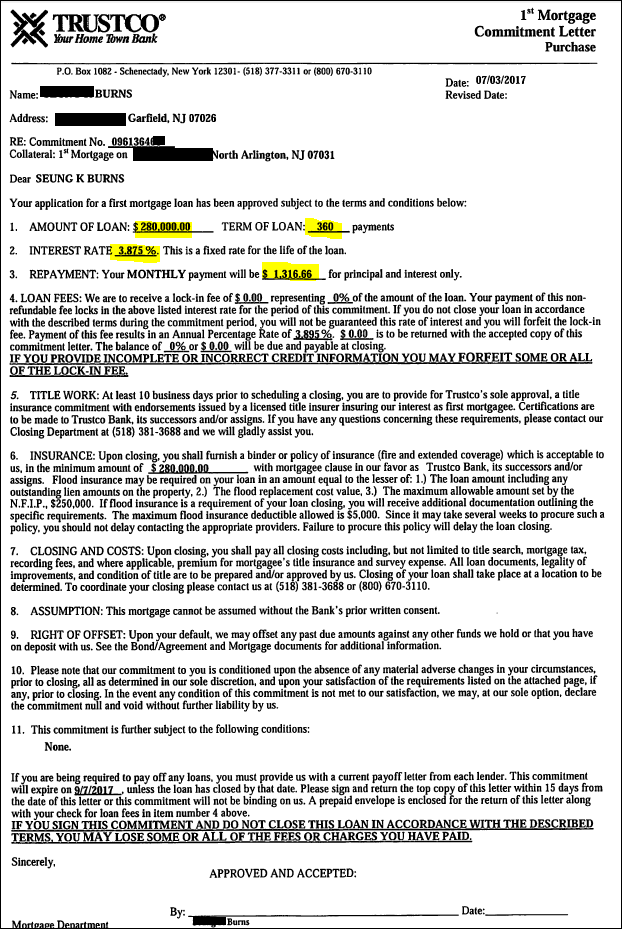

We are again owner occupying. But this time the underwriters for whatever reason are forcing us to put a down-payment of 20%($70k) as opposed to the 10% we put down on the garfield quadplex. I believe we will be locked in at an interest rate of 3.875% for a conventional 30-year mortgage.

6/12/17 (Day 67) – Ponderings on Wealth from Rental Properties

Ponderings: With how well our Garfield Quadplex currently appraised, this second purchase, depending how it appraises will likely put us into owning over $1 million dollars in real estate.

$630,000 + $350,000 = $980,000

More Ponderings: I recently came up with this goal to join the $8350/month club.

What is the 8350 club you may ask?

$8,350/month x 12months = >$100k a year.

Currently while we live in our quadplex we make $4410/month. This Triplex just needs to make us $3940/month from the 3 units. Should be easy enough to get $1400/month for the two 2bdrms and $1140 for the 1bdrm.

And in this way, with just 2 rental properties… we live for free and get $100k/year gross rental income. Anyone else want to join club 8350? Who has already made it?

And yes I do understand that this number is financially meaningless without understanding the expenses, but it’s still a mental milestone I am very much enjoying the idea of.

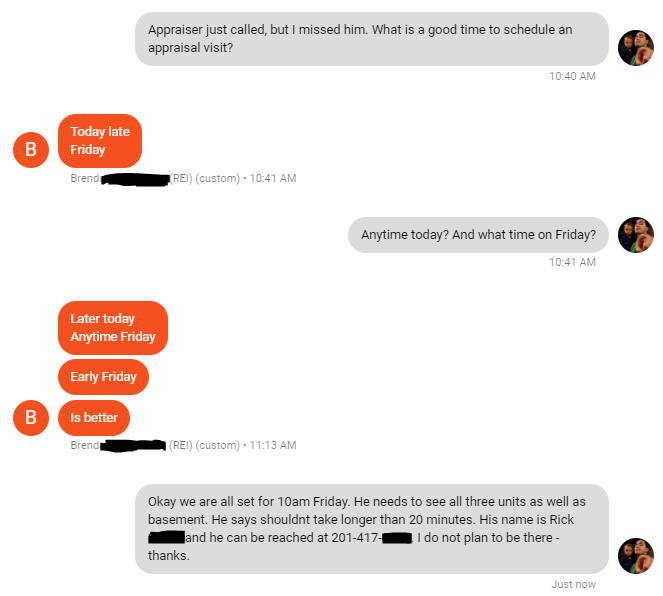

6/14/17 (Day 69) – Scheduled Appraisal for the Property

Received a call from the Banks Appraiser to assess the Property Value for the Bank. Scheduled it for this coming Friday.

6/16/17 (Day 71) – Got Mortgage Estimates Back

So the seller told me the appraisal went fine. I’m excited to see the report to see what the value is… my guess is $425,000.We also got back the good faith estimate for our mortgage in the mail today, super-excited to see that we are locked in for the 3.875% interested rate on the fixed 30 year!

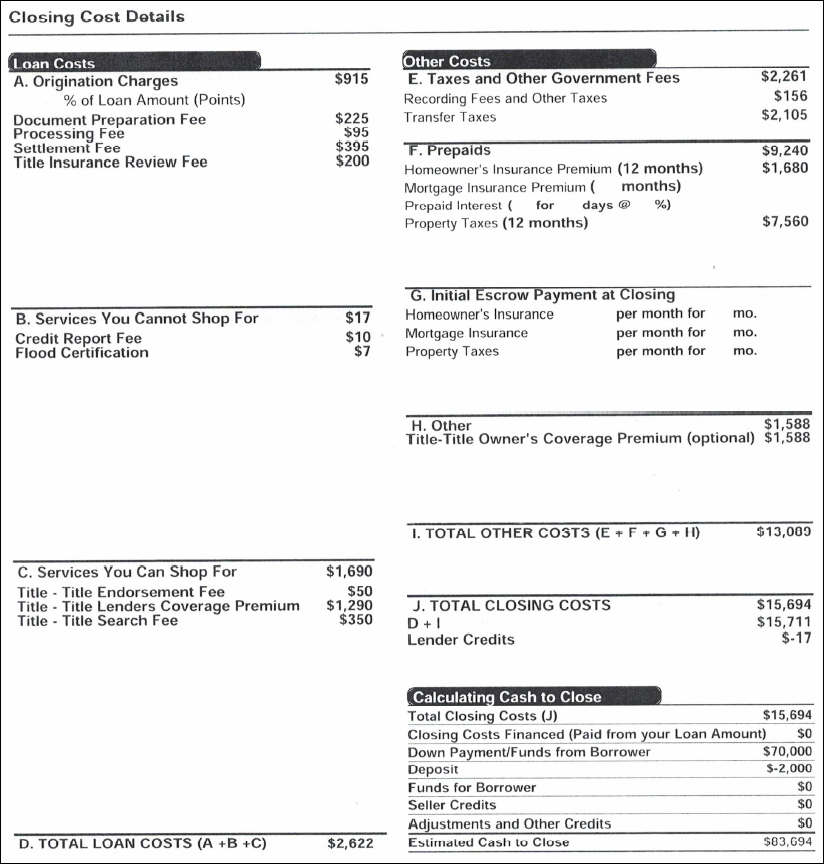

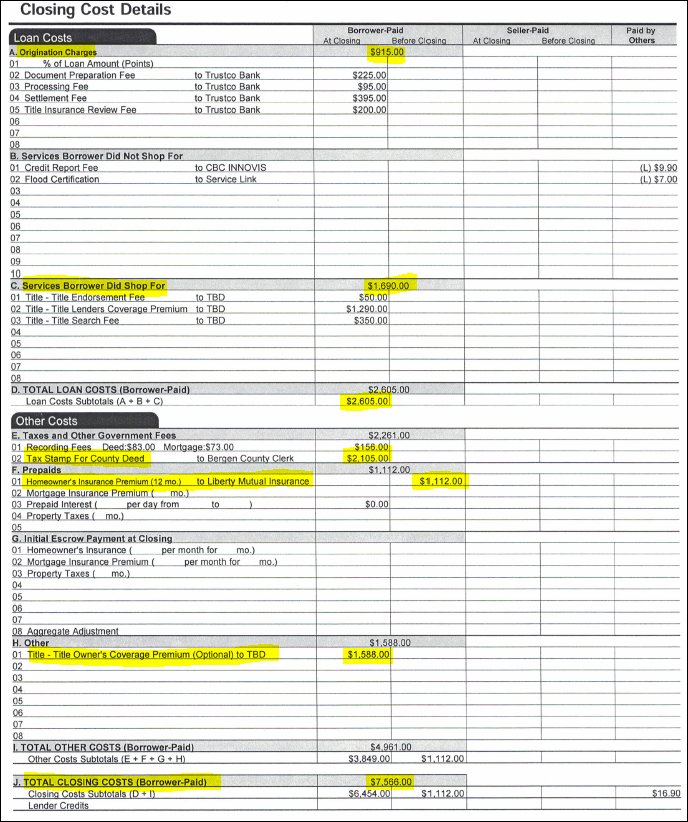

Something interesting to note also was the estimated closing costs and cash-outlay. I think it is worth studying especially if you’ve never dealt with this stuff. So the closing costs appear high since they are including things like Title Insurance, Property Taxes, Years worth of Home Insurance, etc.

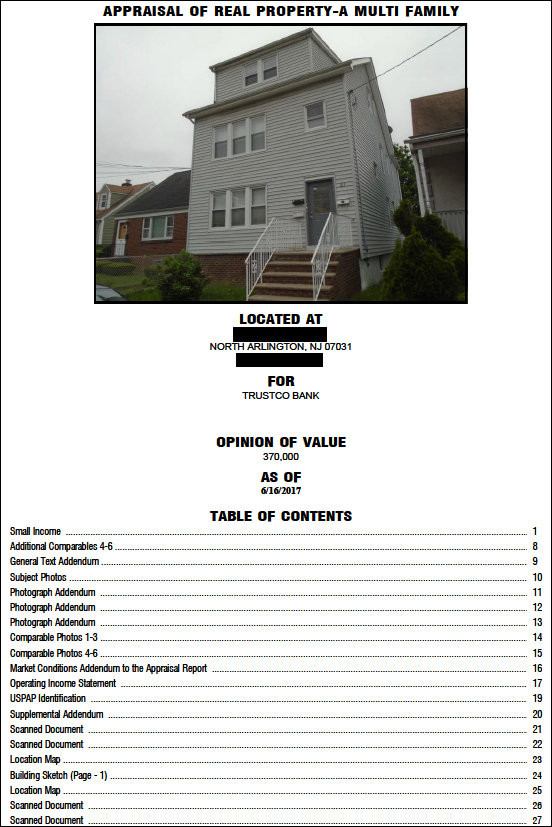

6/27/17 (Day 82) – Received Appraisal Report

Received the results of the banks appraisal. I feel like the appraiser is purposefully undervaluing it. Oh well it’s still over our purchase price so that is the main thing that matters.

Appraised at $370,000. And we offered $350,000.

7/3/17 (Day 88) – Approved to Close from Mortgage Company

Got an email from the bank notifying us that the house mortgage application was approved for closing and that we just needed to provide them the following three things:

- executed commitment letter

- lender’s title insurance policy

- proposed deed

- homeowner’s insurance binder(paid in full)

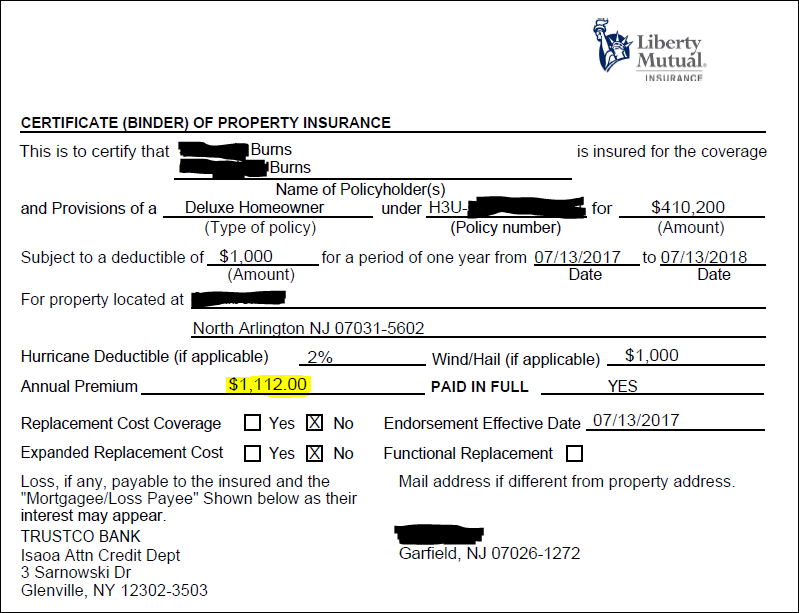

7/6/17 (Day 89) – Got Home/Property Insurance

Back from our trip to Alaska, and called my home insurance company(Liberty Mutual) to add on the new property. Paid it in full ($1108/year), came in much cheaper than I originally estimated.

My attorney got back the title insurance from the title company, I believe the only thing we are waiting on is the proposed deed from the Sellers Attorney.

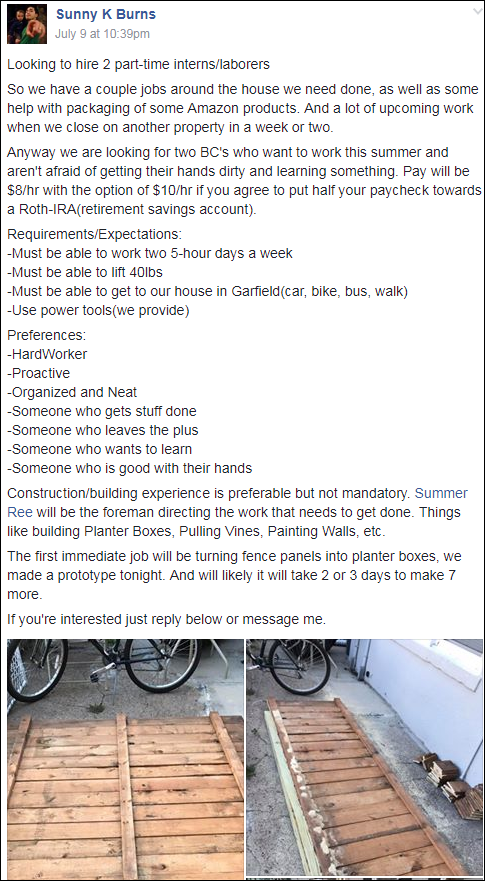

7/10/17 (Day 93) – Seeking Interns/Laborers

Starting to get nervous about all the work ahead with fixing up the property. Wifey and I started remembering all the late nights and hard work we put in when we bought our first. We will contract out a lot of this time around, but also would like to hire some local interns/laborers from our local church community. Here is an Ad I put up on my Churches Facebook:

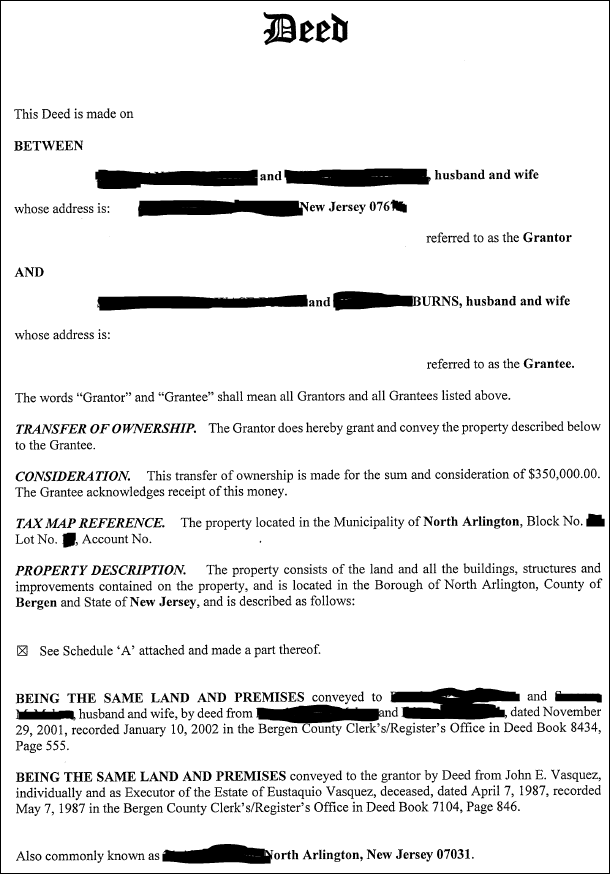

7/11/17 (Day 94) – The Proposed Deed

Received the proposed deed from the seller’s attorney.

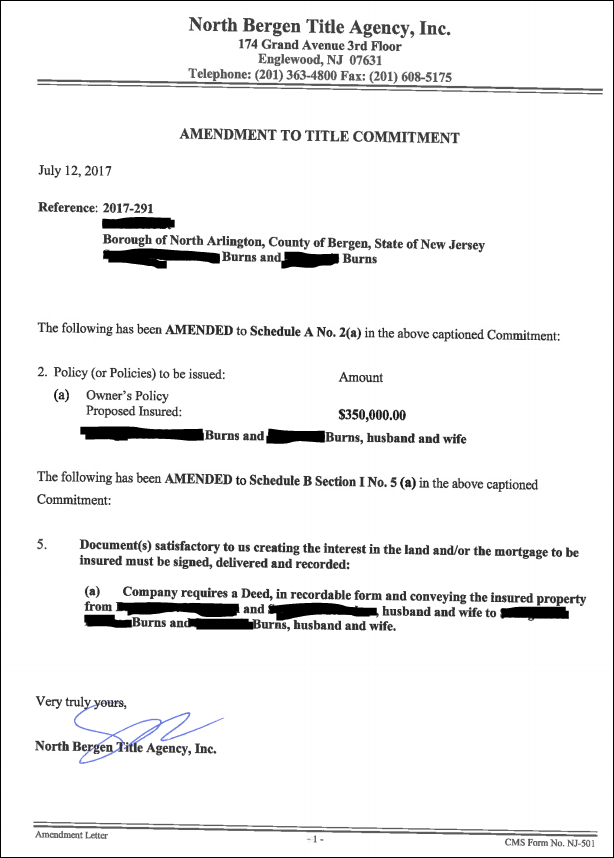

7/12/17 (Day 95) – Received Title Commitment/Insurance

Received the Title Insurance from Title company.

7/17/17 (Day 100) – Received Closing Date and Final Approval

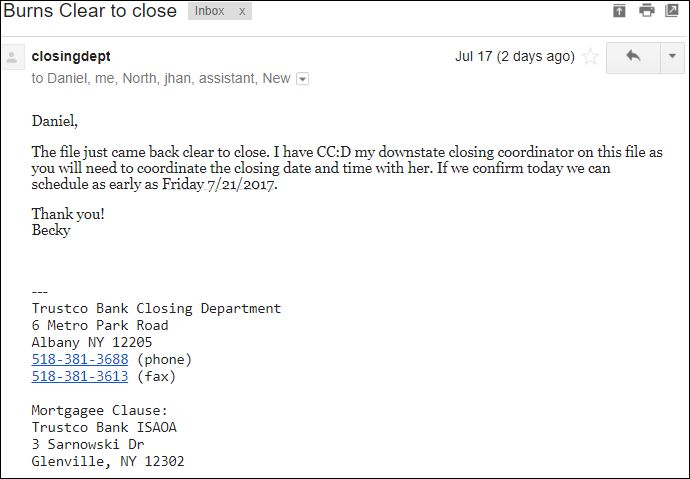

Received the following email from our lender:

7/25/17 (Day 108) – Mortgage Closing Disclosure

So we will have a mortgage payment of $1316 a month, hopefully cover-able by 1 unit’s rent.

So total closing costs are $7,566. But that includes the years home owners insurance premium of $1,112 as well as property taxes of $2105 for the remainder of the quarter.

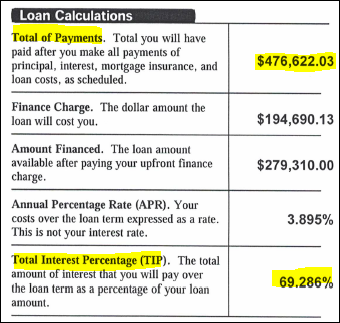

I found this very interesting. So we are taking out a loan of $280,000 but over the lifetime of the loan of 30 years we will be paying $476,622!

7/26/17 (Day 109) – Coming up with $70k+!

So for some reason it didn’t hit me till now, that we need to come up with $70K! cold hard cash for this closing for the 20% down. So luckily we have lots of good options:

- $42,000 sitting in our bank accounts, left over from our cash-out refinance.

- $26,000 that we can borrow from 401K(TSP) at about a 2% interest rate which we pay to ourselves.

- $50,000 of contributions we could withdraw penalty free from our Roth-IRAs.

- $100,000 in credit from credit-cards, some that would hold a 0% interest rate for 12 months

- $61,500 from out home equity line of credit at a 2.49% interest rate for the first 12 months then 4%.

- $X.XX ask for money from people to partner on the deal or borrow from a hard money lender

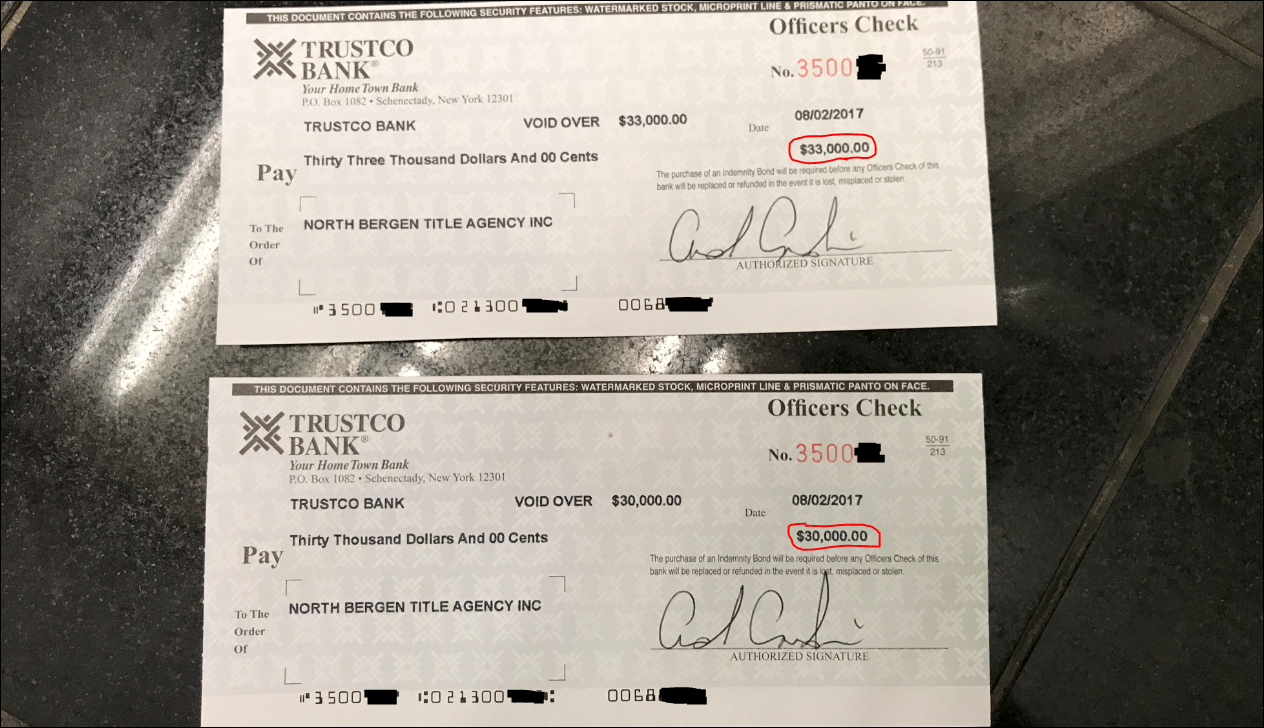

So in the end, we decided on spending $25k(+Closing costs) from out savings account and $45k from our HELOC. Savings was a no-brainer as its just sitting there doing nothing, and HELOC because it seemed the least risky and very easy.

7/31/17 (Day 114) – Final Walk-Through Inspection and KEYS!

We had the final inspection, no surprises. Got the Keys!

8/1/17 (Day 115) – Its always a good day when you find $15,500!!!

So for some reason my attorney and I totally forgot that we had deposited an additional $15,500 for the house…

Nearly had a heart attack and jumped for joy at the same time! Not every day that you find $15,500!

No wonder I had been so shocked by the $70k downpayment… now it’ll be easy to cover. We will likely take out $25k(+Closing) from savings and $30k from our HELOC.

8/2/17 (Day 116) – Closing Day!

The big day is finally here! Took a half-day at work.

Left to pickup the certified checks from the bank (ended up getting a $2,400 refund check as we brought more than we needed just in case).

Got to the Closing at my Attorneys Office, where the Sellers Attorney, my Attorney, Title Agency, and Trustco Bank’s closer also was.

Got to the Closing at my Attorneys Office, where the Sellers Attorney, my Attorney, Title Agency, and Trustco Bank’s closer also was.

- I handed over the checks to the Title Agency Representative

- I signed a bunch of documents for Trustco Bank

- The Sellers Attorney gave me the Estoppel Agreement, Certificate of Occupancy, a check for the security deposit from existing tenants as well as for the prorated rent, and a copy of the notice they are sending to the existing tenants.

- Trustco Bank, cut checks for the seller. One for the sellers bank they had a mortgage with to get that paid off and the second for the sellers themselves with the remaining balance.

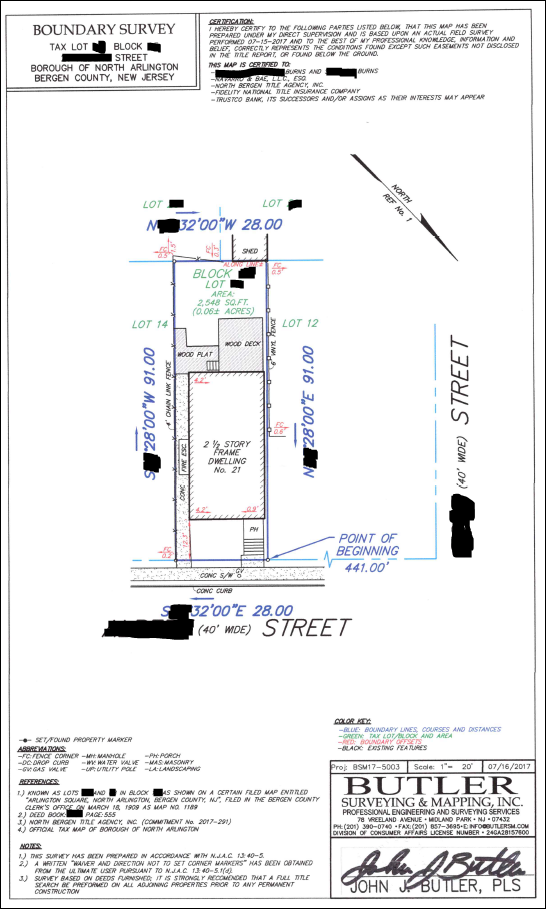

- From the Attorney I got a copy of the updated Closing Disclosure, A copy of the preliminary deed and bond. As well as the survey that was conducted on the property.

The whole process took about an hour.

and at the end of it, we were now owners of $1 million dollars in real estate! So I wrote an epic blogpost to celebrate.

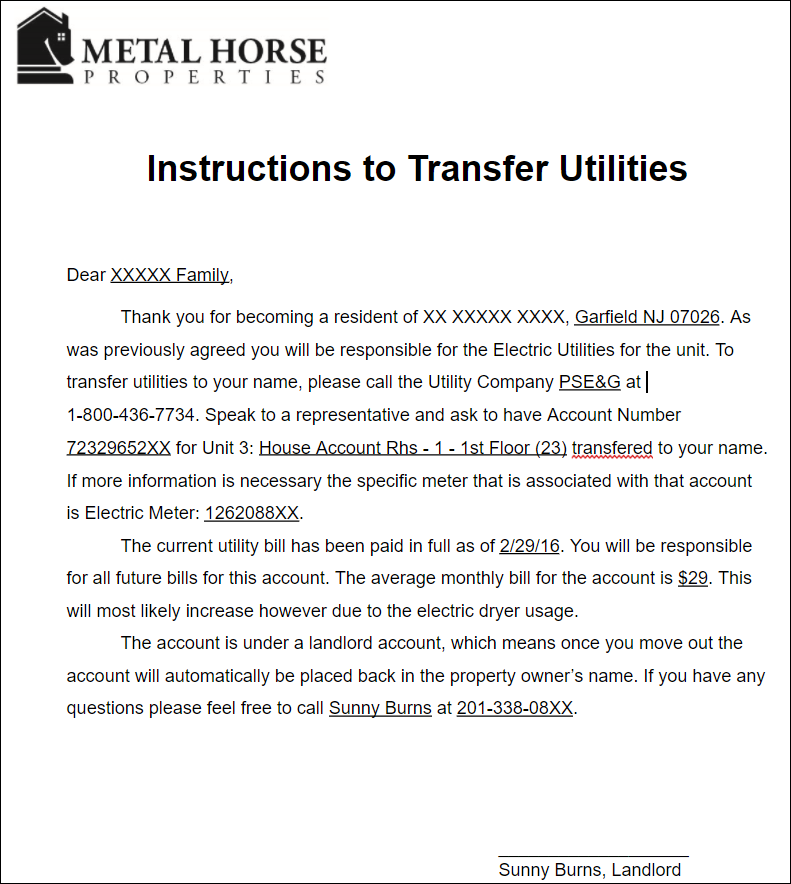

Some house-keeping stuff we still had to do:

- Switch utilities under my name

- Let town know we are the new landlords of the property

- Introduction letter and orientation for tenants

Phase 2 – After Triplex Purchase

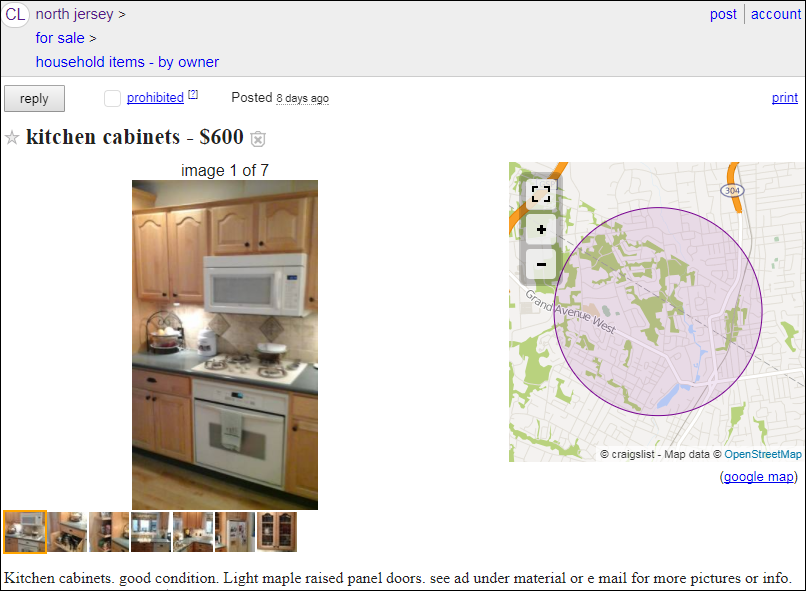

8/3/17 (Day 117) – Buying Used Kitchen Cabinets

So the next day, my wife very excitedly made two appointments to view two used kitchen cabinets that she found on craigslist and facebook Marketplace. We ended up buying them both.

Here is the other set – 18 cabinets total. Price $400. Location in Ramsey. Removed and Ready for pickup. Solid wood- light birch. No counter-tops – both sets luckily were already pulled out and ready to just be picked up.

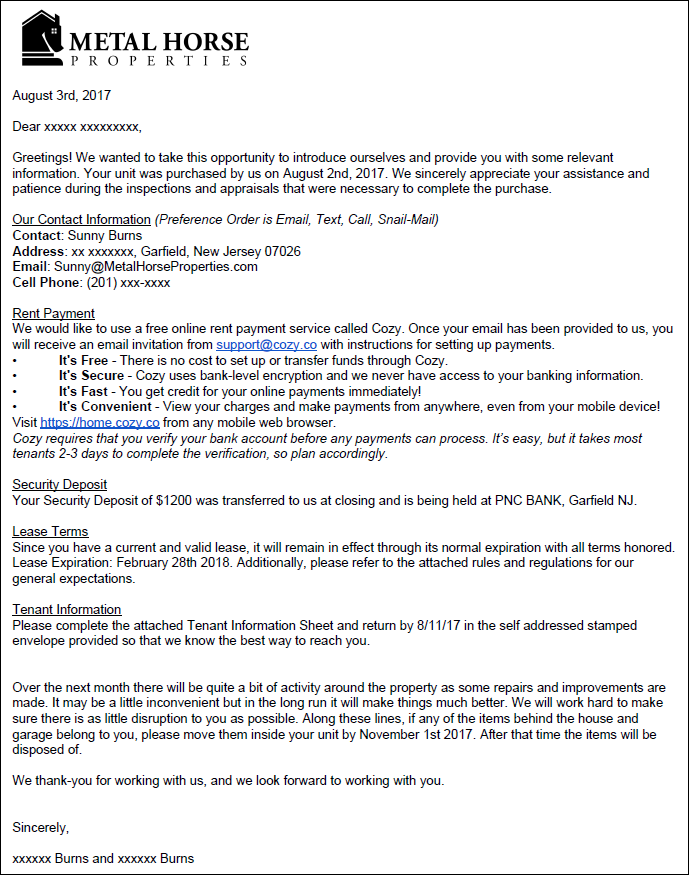

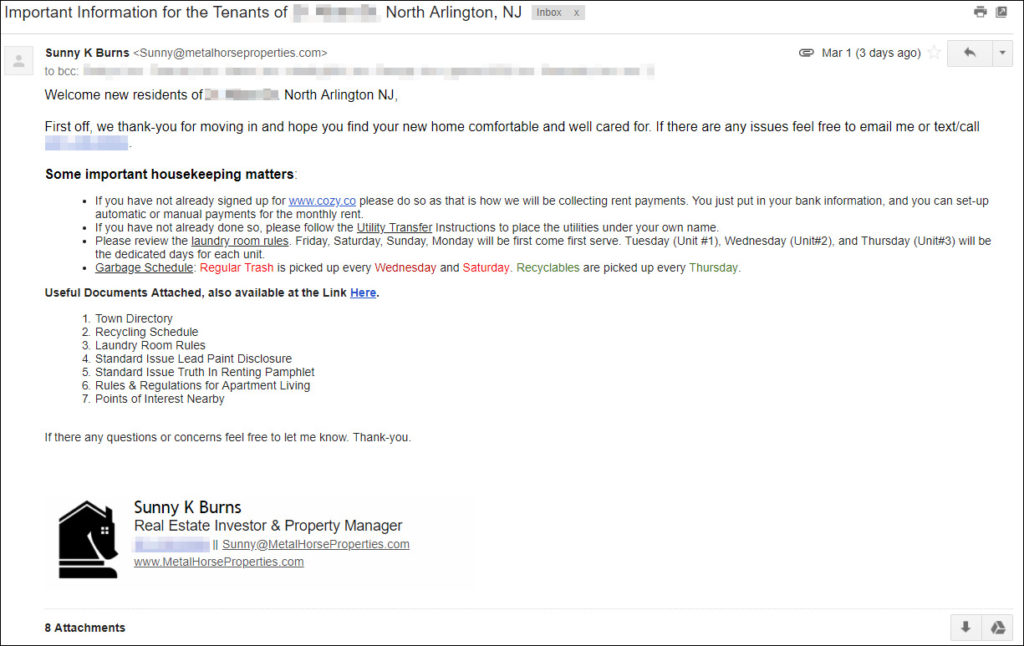

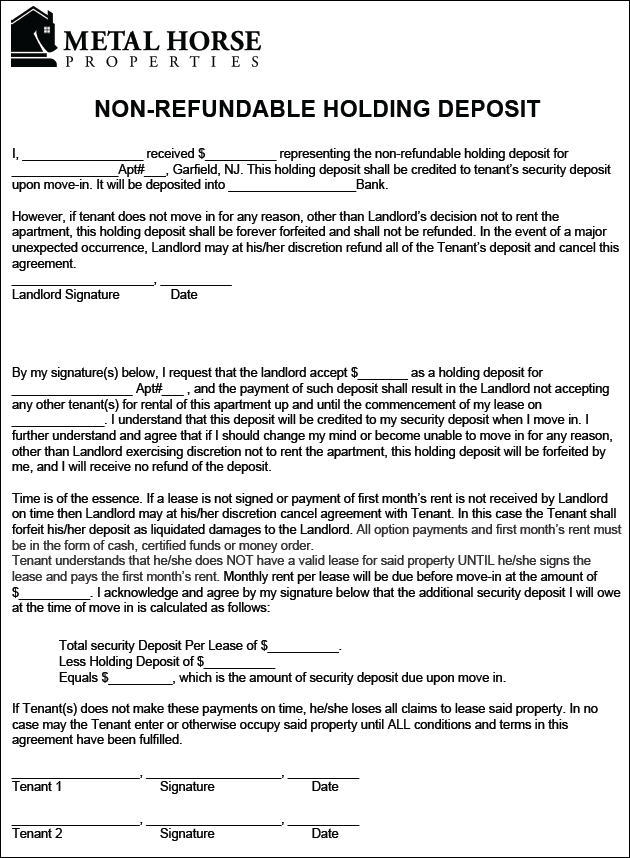

8/4/17 (Day 118) – Introduction to Tenants, Letter

Below is the letter we sent to our inherited tenants as their new landlord. Basically going over how we like to receive automated payments through Cozy.co as well as just a general introduction and our contact info should they need to get a hold of us. We also informed them that we now have their security deposit and are requesting updated contact info from them.

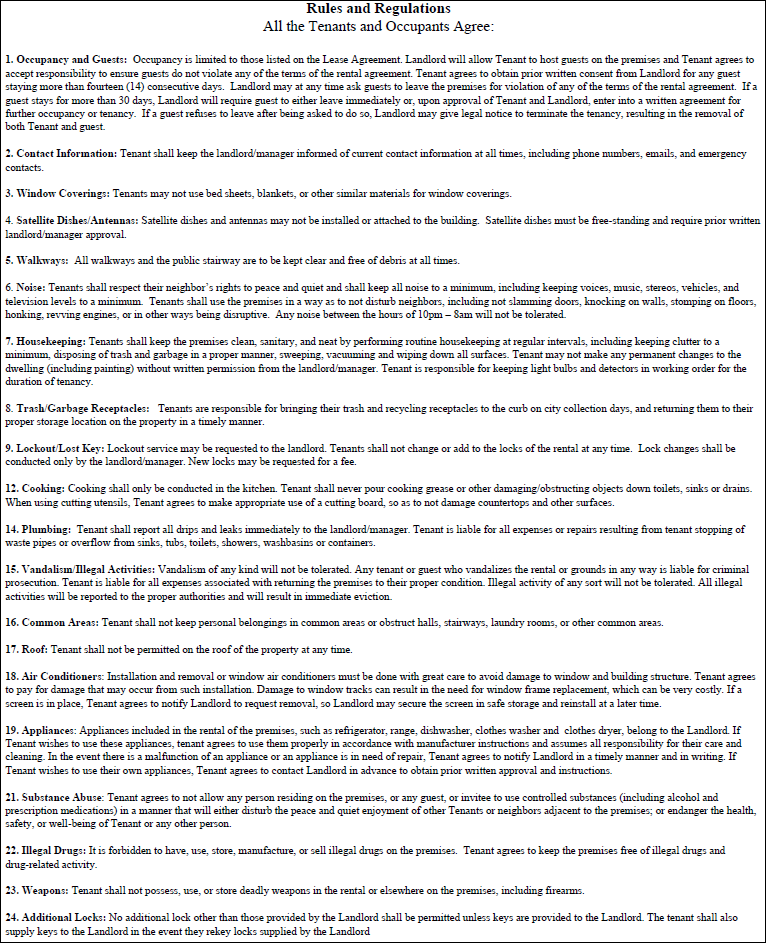

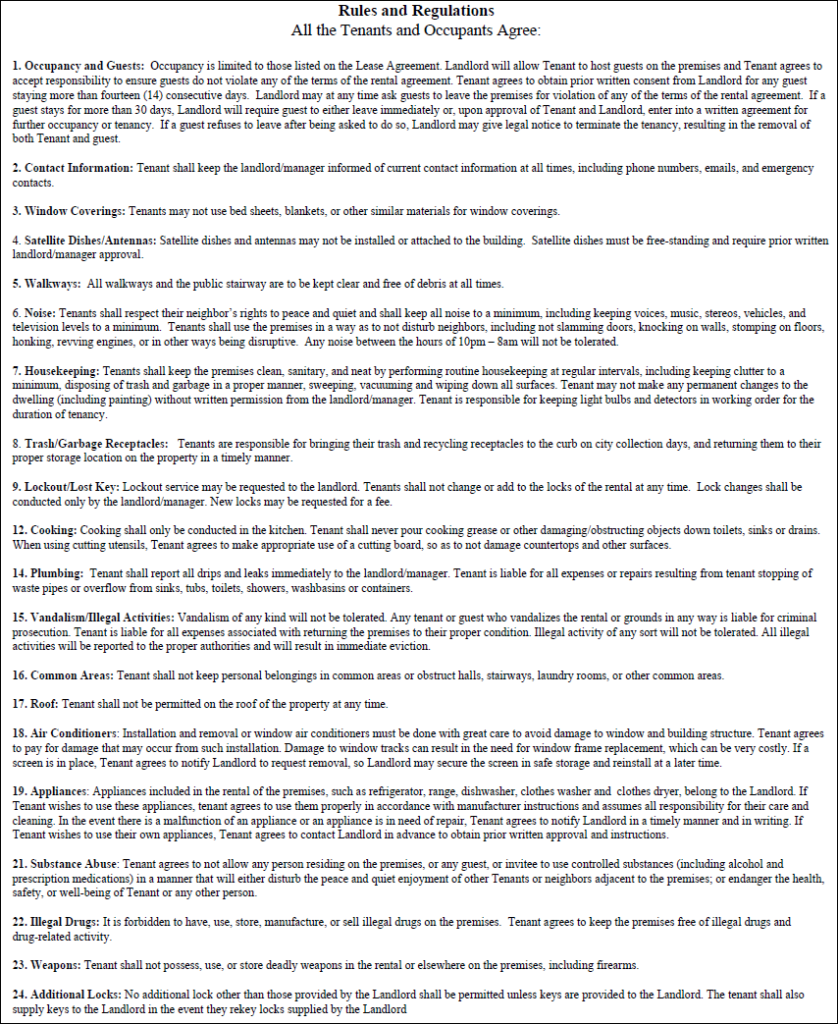

Attached with the letter, was also some general Rules and Regulations that is in our standard lease.

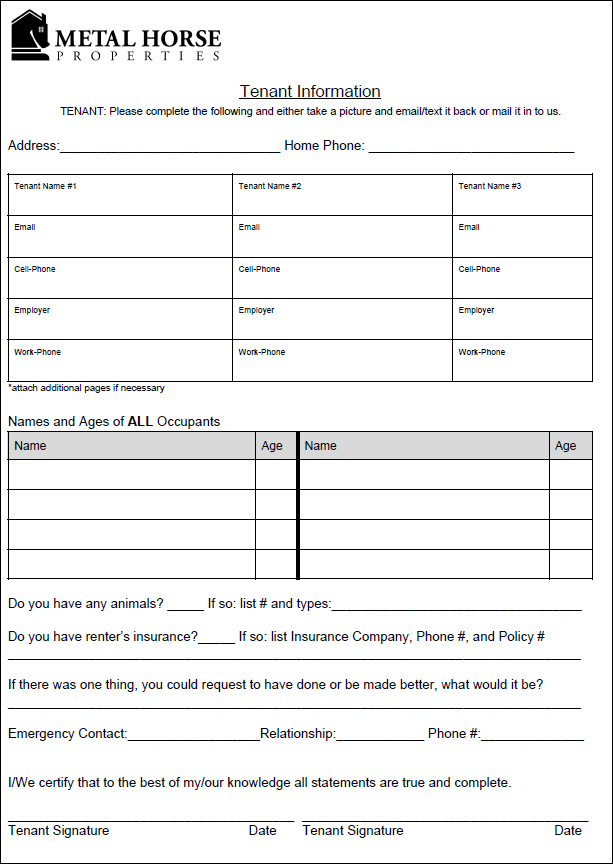

Then the last thing we attached was a self addressed stamped envelope, a business card, and this Tenant Information Form.

8/5/17 (Day 119) – Making Task List and Assessment

So we went to the house and really started to access everything that we were going to need to do to make it the way we want and get market rents.

Our Preliminary Task List

Write welcome letter and information retrieval letterGet security deposits and estoppel agreement- Move tenants to cozyco payments

- Register with town as new landlords and get new town CO

- Coordinate with Contractor when he can start work

- Fix front porch railing and steps

- Flooring plan for 3rd floor unit renovation

- Paint and refinish stairwells

- Find person to mow lawns

- Get tax appeal

- Inspect roof

- Create a map of things to do near property

- Set up shared laundry coin-op

- Buy new kitchen cabinets for 3rd floor apt

- refinish deck

- Landscape front lawn

- Get matching mailboxes

- Get Shutters

- Paint front door

- Paint entire back-stairwell and laundry room

- Figure out fuses if ok to keep or not

- Pick target date for 3rd floor rental and open houses

- Find out why basement heat not working

- Get rid of suspended ceilings throughout house

Options for Basement, ask Town

- Leave alone

- Use as storage

- Create as multiple storage units

- Create stairwell down to make bigger 1st floor unit

- Get Variance to make it another unit

- AirBnB it

Also to show the tenants that I am a hard-working landlord, who is not there to just take there money and not do anything… I decided it would be a good idea, to spend a half-hour or so pulling the weeds in the sidewalk. I feel that getting your hands dirty shows your tenants your not above them, and that you care about the property, and that you are providing them a service. (For this very reason, I still haven’t broken down to buy a snow-blower or plowing service at the quadplex).

8/6/17 (Day 120) – Clean out and Paint Sample

So I invited my sisters and parents to come over after church and help clean out the third floor unit. In return I told them I would treat them to Boston Market(Luckily one happens to be only two blocks away, a major perk of this property!)

We also changed a flickering light bulb in the hallway, and swept and vacuumed the whole place.

8/8/17 (Day 121) – The Dark Side of Real Estate Investing

So I got home just after midnight… I had gotten off work, and went straight to the U-haul Rental – Since we have smaller cars, whenever we need to move big things we either rent a U-haul ($20-$30 + $1/mile for 24 hours) or a Home Depot Truck ($20 for 75 minutes, $5 for every 15 minutes after that) – from the U-haul place I went home to Garfield to pick up some supplies and meet up with Ken – Ken had reached out to me a week or so earlier asking to take me out for a cup of coffee and question me about real estate investing, since I don’t drink coffee, and would rather make it more of a mutually beneficial experience I asked if he would mind helping me pick-up some cabinets. – From there we hit Ramsey, our first stop and picked up the first set of cabinets ($400).

After that we hit Montvale to pick up the other set of cabinets ($500). Unfortunately no pictures as it was getting dark. But we had to double stack on top of the other cabinets, that U-haul was full!

At this point it was reaching 9pm, so I dropped Ken off and continued on to North Arlington. (Shout-out to Ken for being a huge help!) I called my brother to help me unload the rest.

So in the dark from 10pm to 11:30pm we(Brother and his Wife[Thanks Steph the help was huge] and I) unloaded that U-haul into the triplex basement.

I got home at 12:20am and was dead tired… battle scarred, but clean, I went off to bed and into the embrace of my sympathetic wife…. Only to awake 4 hours later to get up for work at 5:45am.

While you’re out there partying, horsing around, someone out there at the same time is working hard. Someone is getting smarter and someone is winning. Just remember that. -Arnold Schwarzenegger

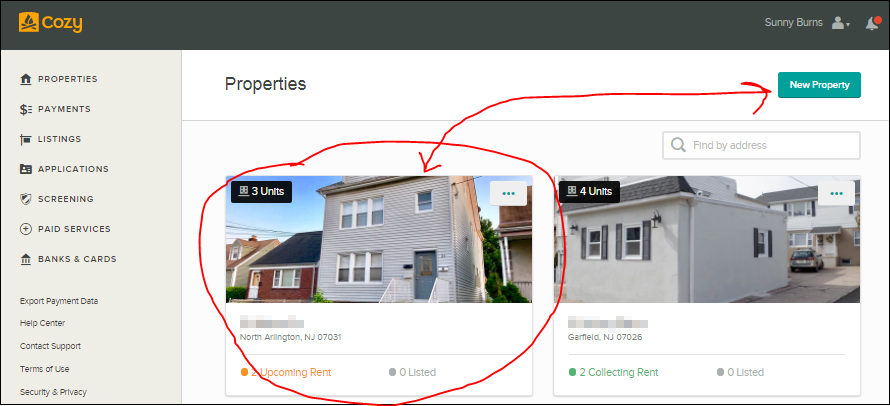

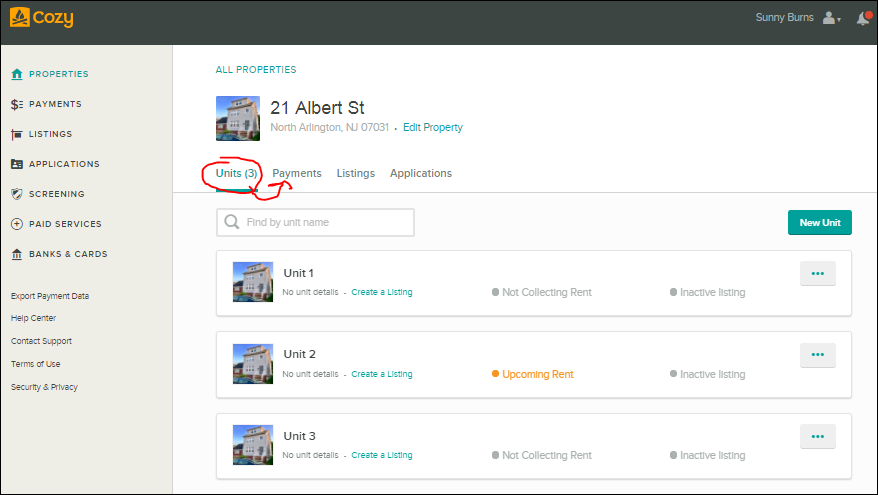

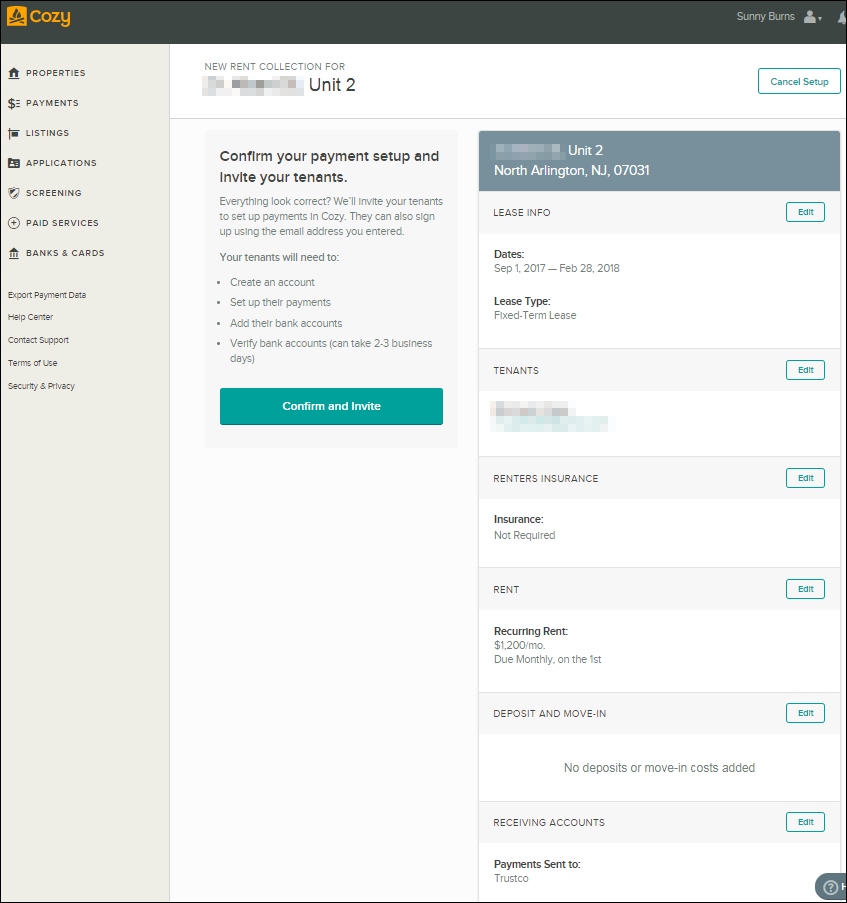

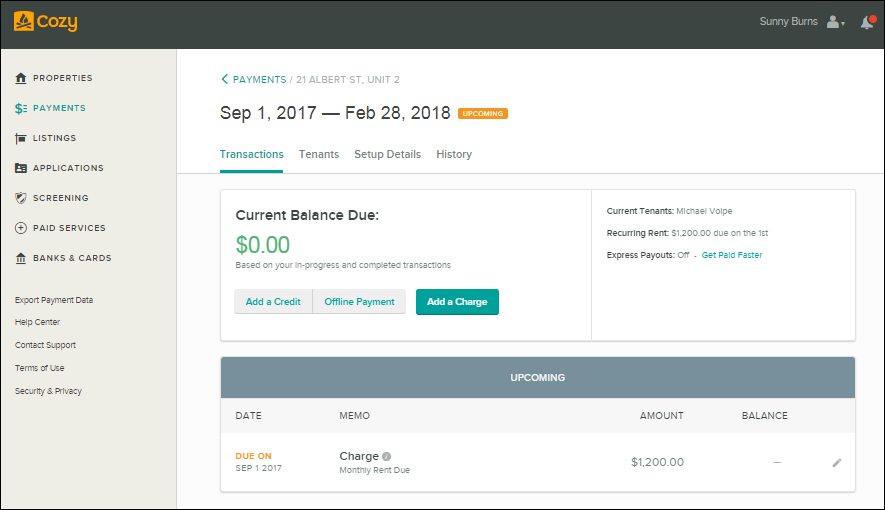

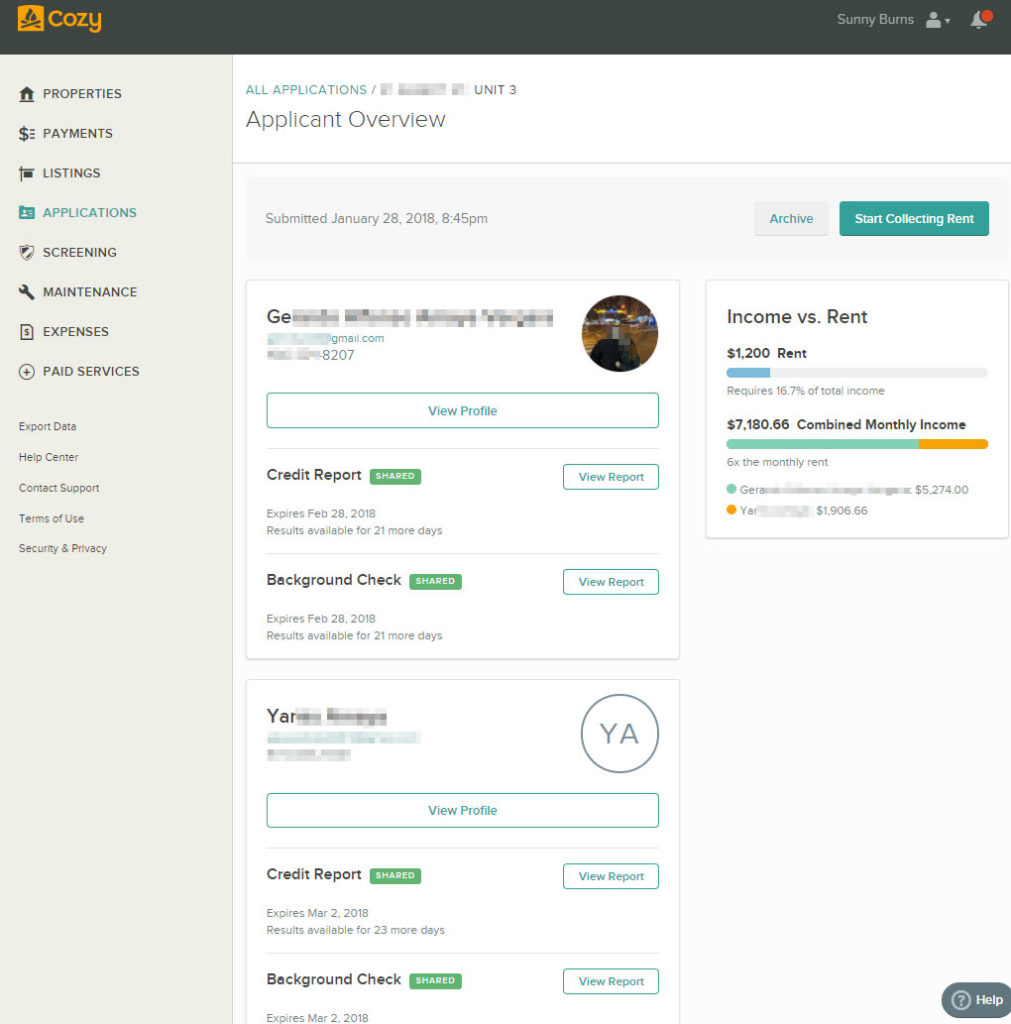

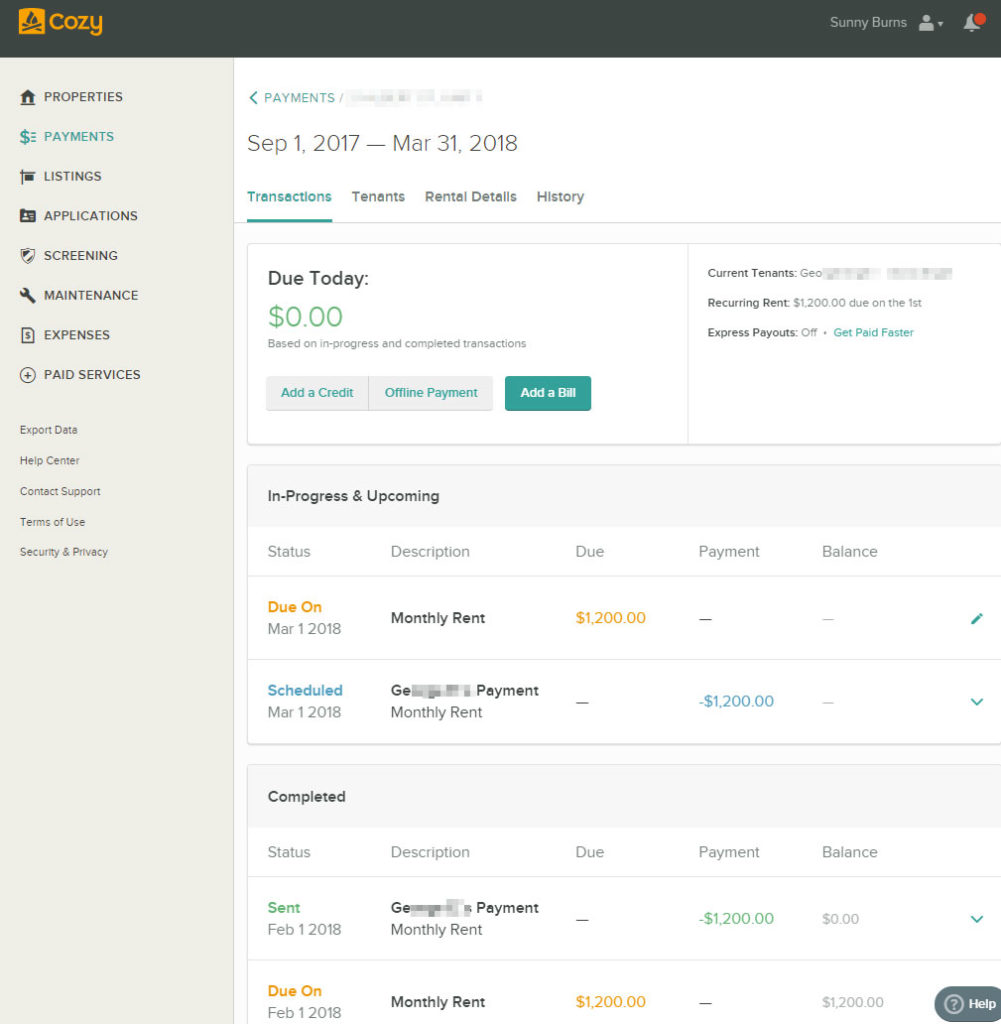

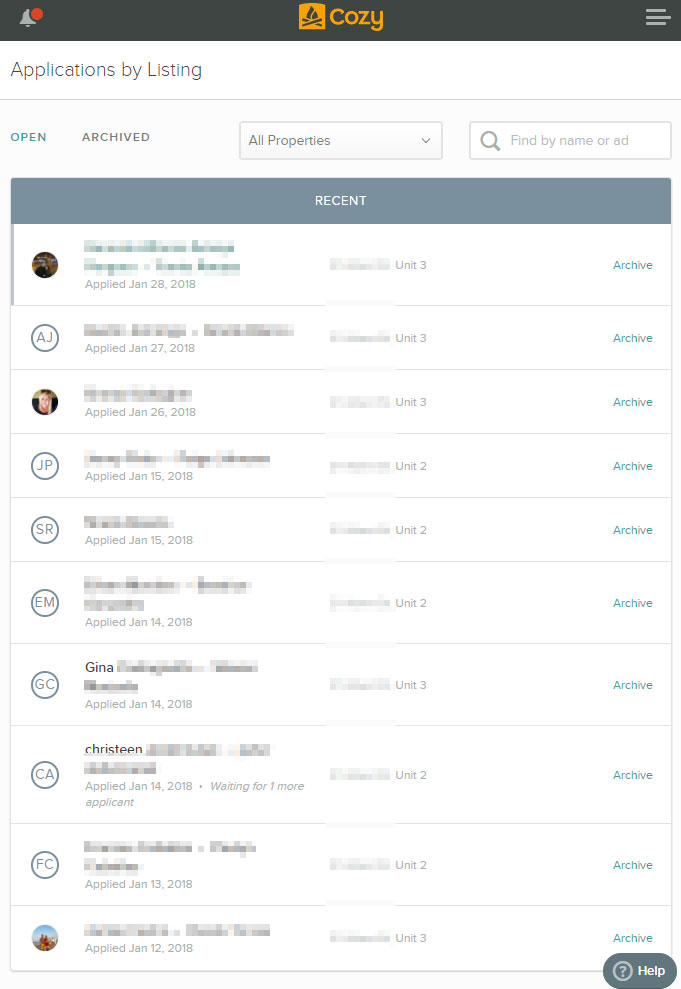

8/15/17 (Day 128) – Setting up Cozy (Automated Free Online Rent Collection)

I cannot say enough good things about Cozy, and I can safely say that every landlord should be using them.

Great things about Cozy

- Free Online Rent Collection (Tenants Bank Account to Yours)

- Online Application Collection

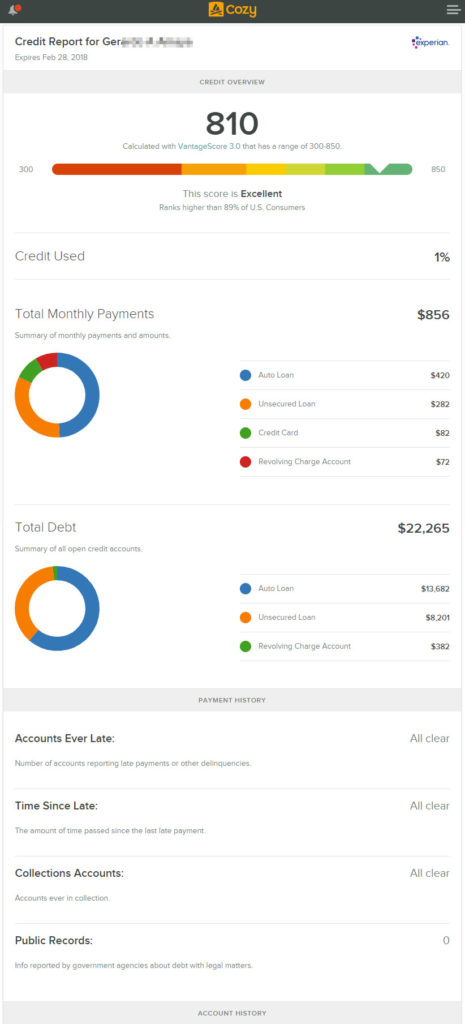

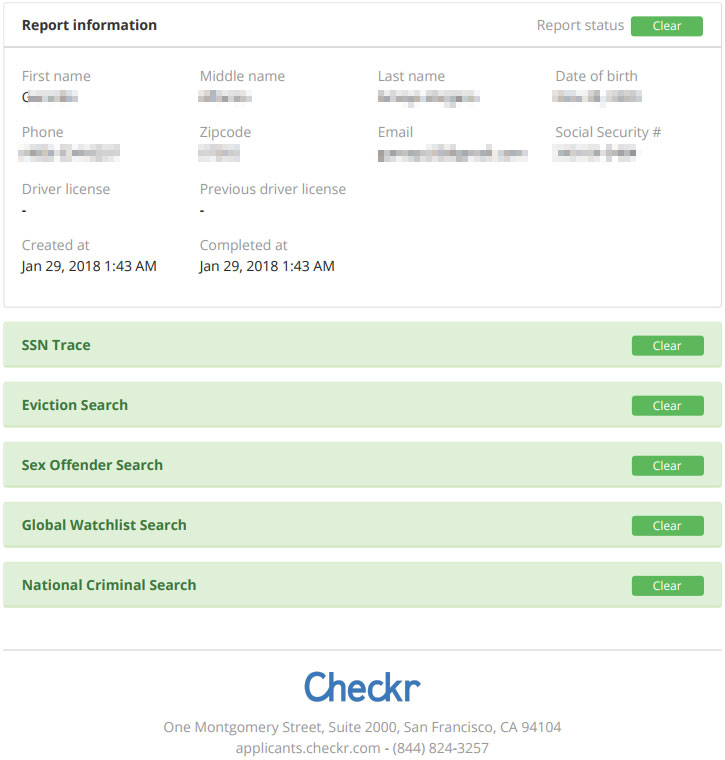

- Optional Tenant Paid $24.99 background check

- Optional Tenant Paid $24.99 credit check ($39.99 for both)

- Tenants can pay by Credit/Debit card but would be charged a 2.75% transaction fee

So since I am inheriting these tenants, I just have to sign them up for the service. I won’t be collecting applications, and doing credit score or background checks this time.

For instance we charge a daily $10 late fee, so I just add that as a charge at the end of each day rent is late. We’ve also had tenants pay in cash for one reason or the other, and can just credit them the cash deposit. This would also be useful if you were splitting utilities.

As you can see a very simple seamless but invaluable tool for landlords.

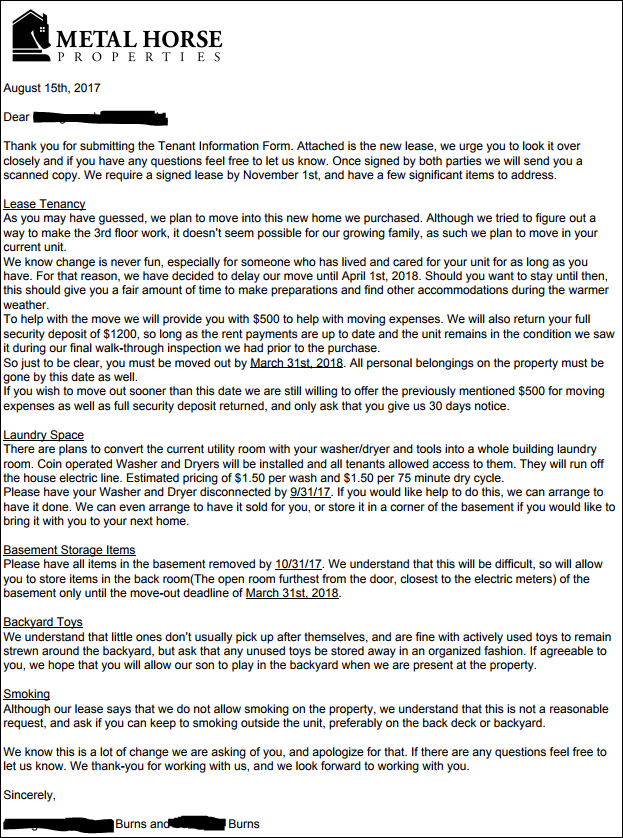

8/16/17 (Day 129) – Letters to Tenants of Non-Renewal, and Leases

So today was a tough day in landlording… we had to send notices to the tenants that we would not be renewing their leases…

We also sent them leases(Link to our Sample Lease) that we would like them to sign in the mean time while they are still our tenants.

8/20/17 (Day 133) – $200 House Face-lift that will Transform your Property in a Single Day

It is amazing what a fresh coat of paint can do to transform a property. In this post we discuss four simple, fast and easy ways to instantly boost the curb appeal of your home!

When we finished these minor updates, our neighbors came up to us and were shocked! They were amazed at how the place now looked. And all it took was a few hours of hardwork and a few hundred dollars in materials.

When we finished these minor updates, our neighbors came up to us and were shocked! They were amazed at how the place now looked. And all it took was a few hours of hardwork and a few hundred dollars in materials.

Materials:

- Shutters ($20-$38 a set)

- Mailboxes ($21 each)

- Mailbox Decals ($8 for two)

- Mailbox Letters ($6 for set)

- Door Paint ($12 a quart)

- Railing Paint ($9 a quart)

So all we really did was put up shutters, replace the old unstandardized mailboxes, and paint the door and railing to match the shutters.

A majority of the work took about 3 hours, but we had to rent a home-depot 25 foot ladder($25/4hrs) to put up the middle shutters, and those railings took forever to paint. I’d suggest spray-paint for anything as ornate as that.

8/21/17 (Day 134) – Bathroom Remodel

So we hired a contractor to start remodeling the bathroom in the third floor vacant unit. We like the contractor as we used him before, but since he was swamped he had to subcontract it out. We’ll see how it goes.

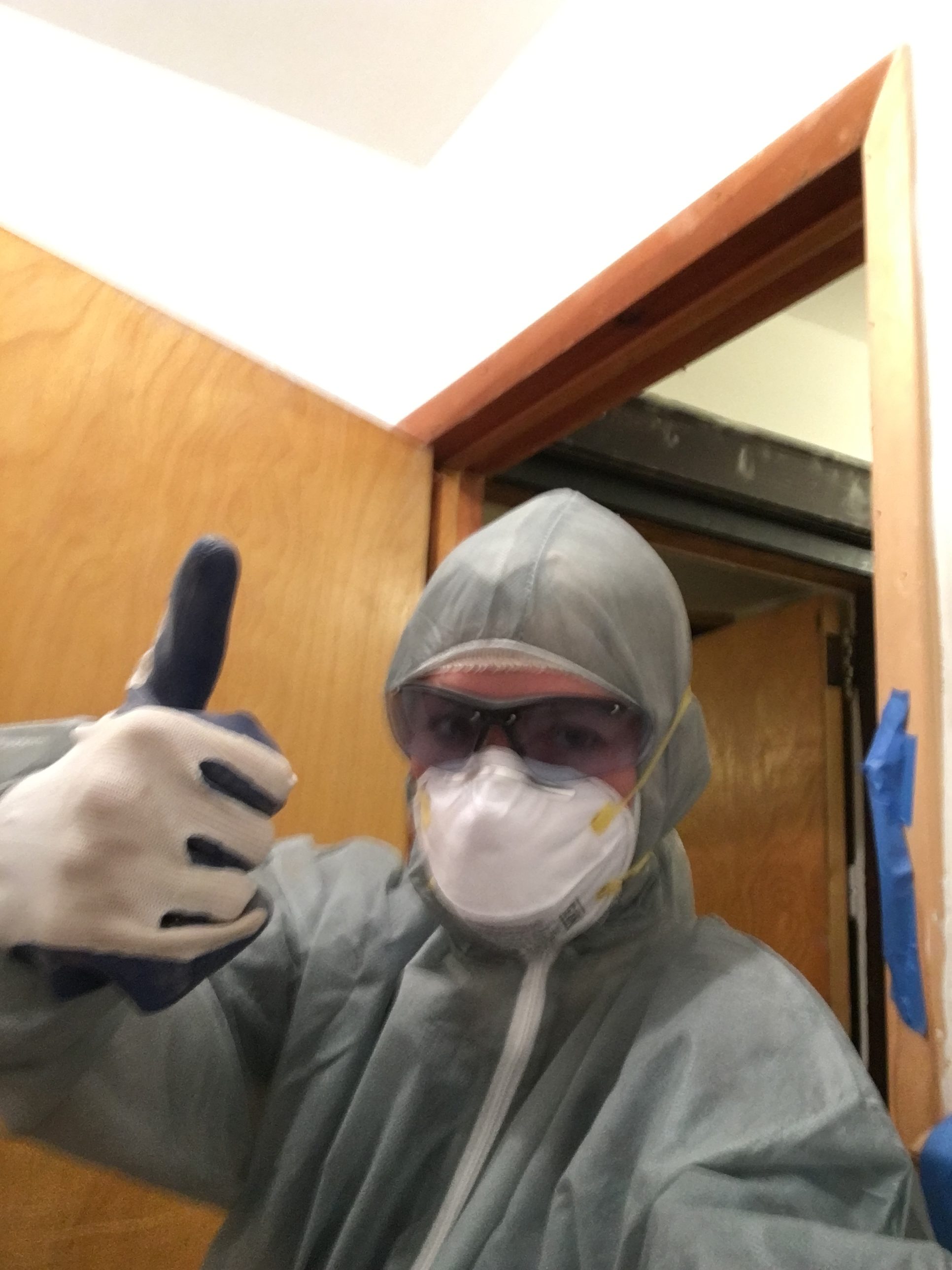

9/13/17 (Day 157) – Why being an Investor is Hardwork… Contractor Issues…

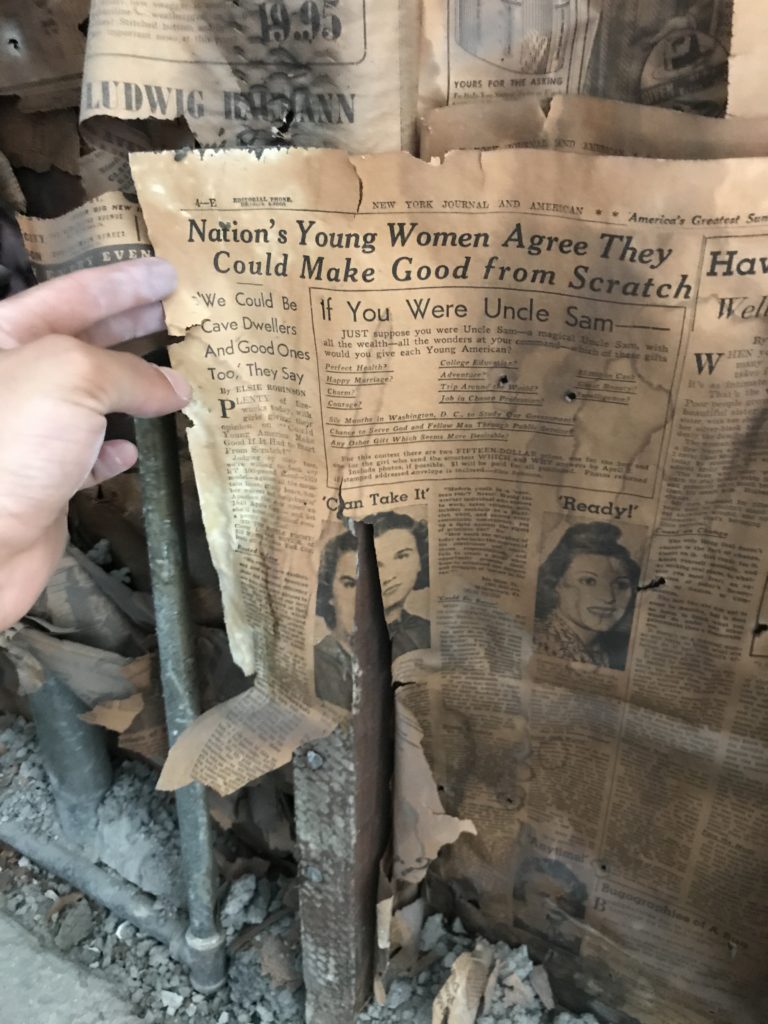

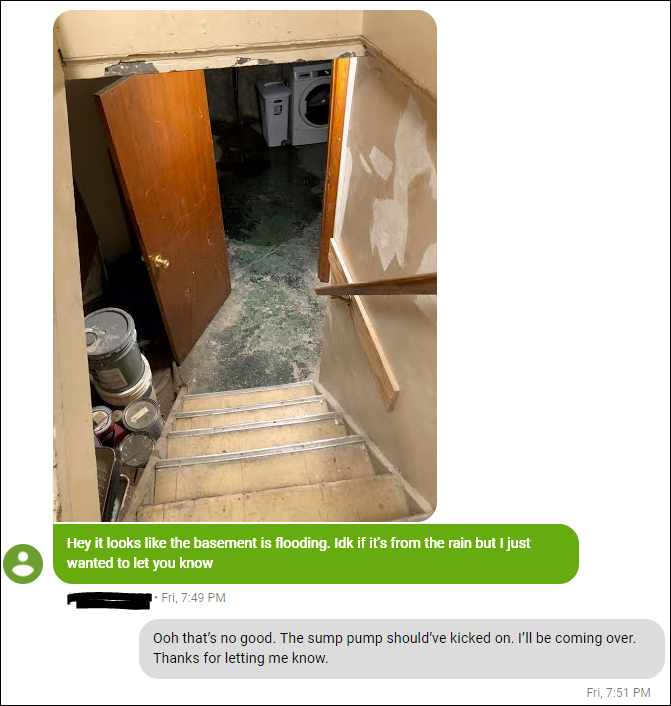

I finally finished with a 2-week ordeal, that involved a leaky drain pipe, the subcontractor’s and the second floor tenant.

It was probably a week after the subcontractors started working on the third floor bathroom, when I got an angry call from the downstairs tenant, saying that water was leaking through the ceiling!

Every landlords nightmare phone-call…

Luckily it was leaking right into the tub and oddly enough into the toilet bowl.

Due to some miscommunication(The tenant forgetting to leave the door open) we had delays and weren’t able to find the source of the leak till a few days later:

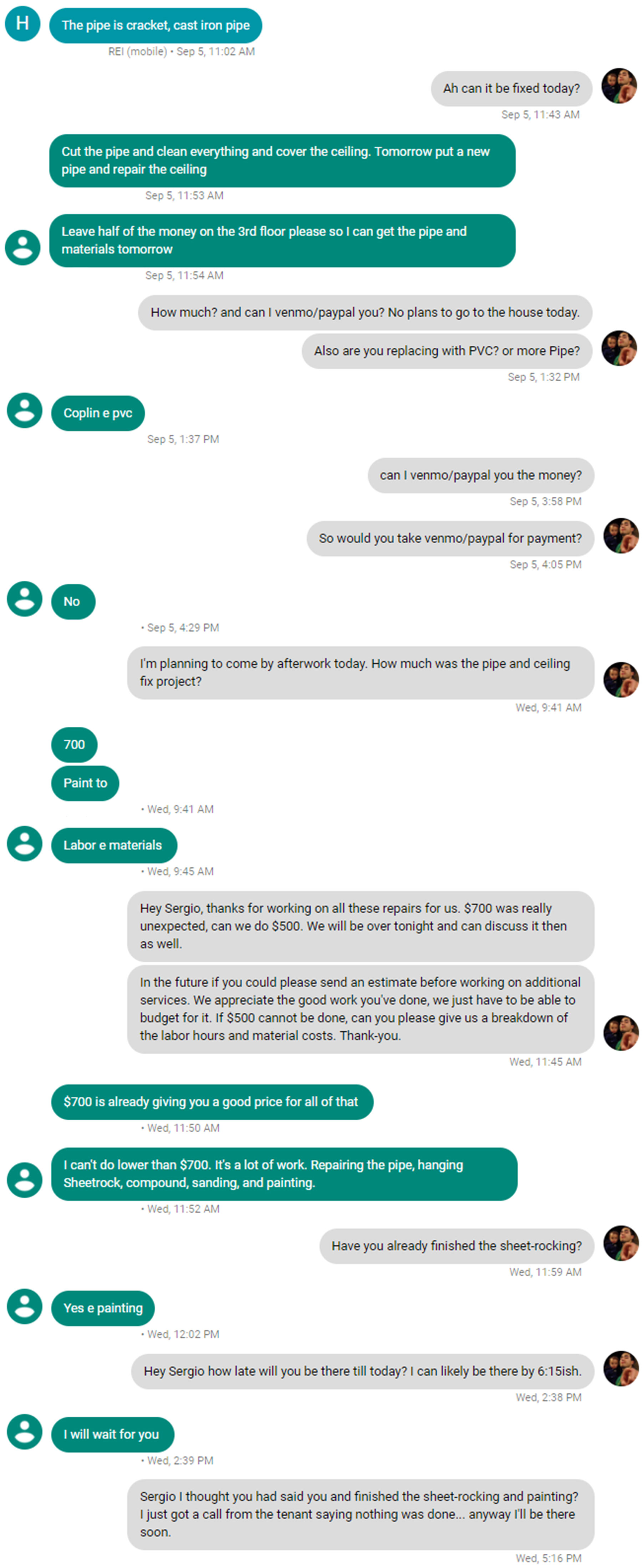

This is the text conversation I had with the subcontractors following the discovery. Read it till the end.

Sunmarie and I both confronted him with our two kids in tow, I think he felt very badly and didn’t even want to look at us in the eye.

My guess is that the subcontractor lied that he had “Finished” so that he would get the job and the payout. After speaking face to face, he said it was a typo… but it seems fairly clear.

For what went down I feel we handled it very well and coolly, and left it on decent terms. He was to finish the bathroom under the predetermined contracted rate, and I would handle the leak repair myself.

Then came the drywall.

Finally finished the job last night, and honestly it was a lot more work than I expected.

I still feel $700 was high, as it probably was about $70 in materials. But just to smooth things over a little better with the contractor I sent him a text saying that it was a lot harder than I had initially thought.

9/25/17 (Day 169) Top 10 towns of 2017… and More Work, Coin-Ops, and Tenant Moves

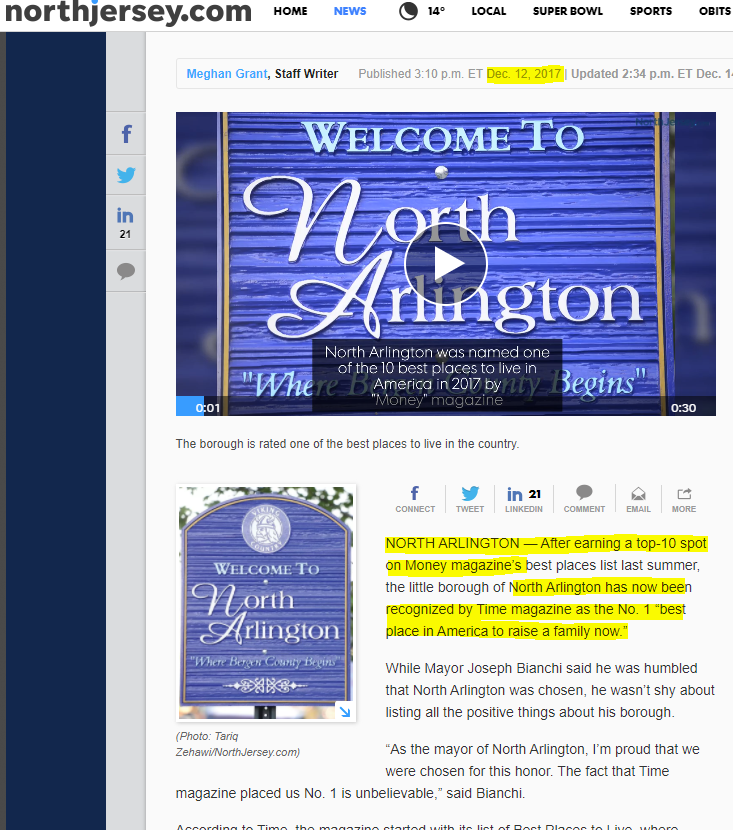

So it appears we lucked out by buying in Money Magazine top 10 places to live! Kind of a cool statistic, we will definitely have this magazine out during our rental open house.

We had bought some coin operated washer/dryers off craigslist, and moved them into the basement. We felt this was necessary as currently only the first floor has laundry access and its hooked up to their utilities, but we felt it was a huge value add to get coin-ops that all three tenants could then use.

Unfortunately there is no gas meter for the owner, just an owners electric meter, so we had to get an electric dryer.

The second floor tenant gave us notice at the beginning of the month that he would be moving out, so we’ll have to make preparations for that.

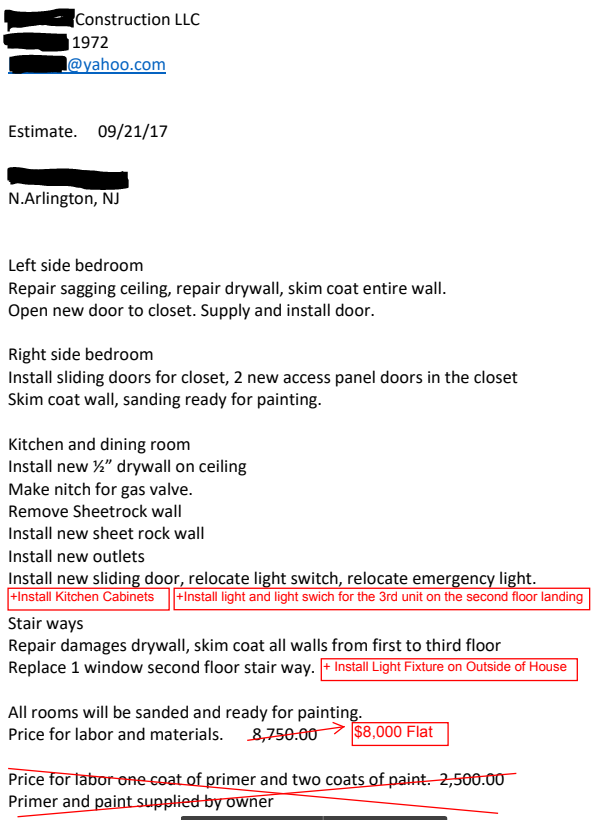

We are going to replace a lot of the sheet-rock in the third floor unit and hallways, we received a quote from our contractor for that. Was a little pricey, but I do not have the time to get it done myself. He starts tomorrow. We did a little back and forth on price, I also redlined his quote to add some more things, eventually we settled on $8,500.

12/1/18 (Day 230) Updating

12/13/18 (Day 248) Time Magazine names North Arlington #1 Town to Raise a Family in America

So a month after we purchased our triplex in North Arlington, NJ – Money Magazine ranked it in the top 10 towns in country.

Now 4 months after we bought the house – Time Magazine named it the number 1 place to raise a family in America!

Lucked out somehow (Objectively speaking, we don’t see it). Definitely will have the two magazines laid out during the open house.

12/28/17 (Day 263) Finished Renovations on House, Before/After Photos

1/6/18 (Day 272) Took Pictures for the Listing

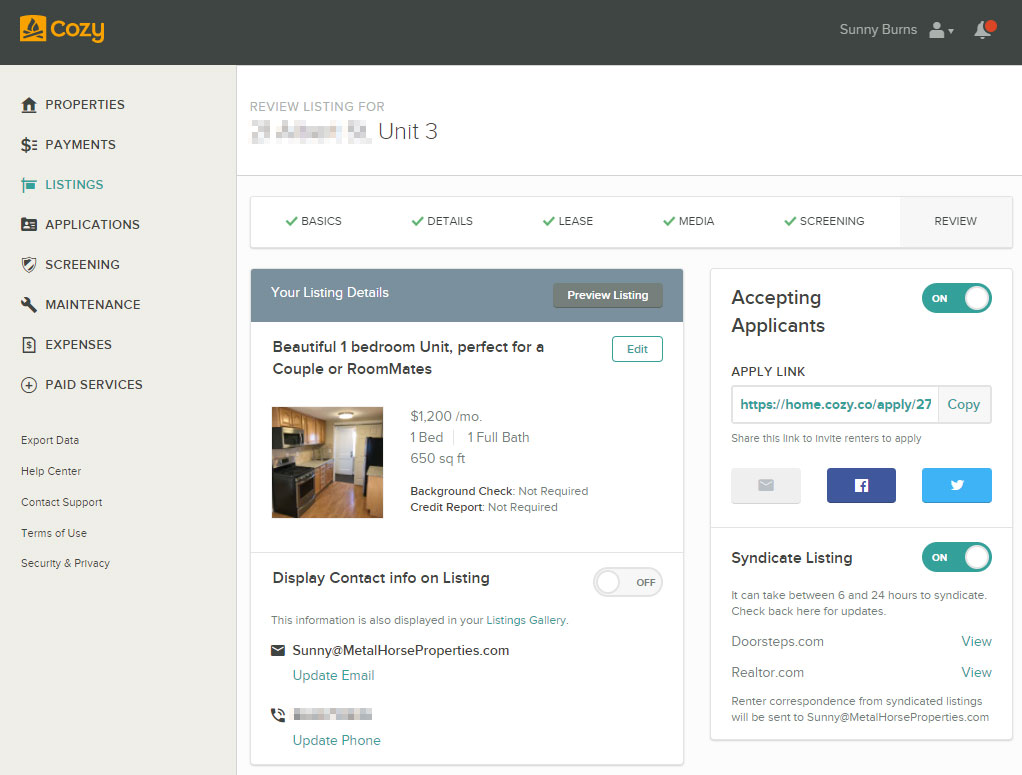

1/7/18 (Day 273) Advertising the Unit

I listed the property on Zillow Listing Manager(Zillow, Trulia, Hotpads) and Cozy.co (Realtor.com, Doorsteps.com) and Craigslist.

But this time I also listed on Facebook Marketplace and the response from FB has been crazy! In just one day of listing I had 4,500 views of my FB listing, as well as 50(Total was around 65) inquiries…

For those that are curious this is the verbage I used in my ad(recommendations and critiques are welcome):

Dates of Rental Open House:

- 1/13/18 (Saturday): 11am-1pm

- 1/14/18 (Sunday): 3pm-5pm

- 1/17/18 (Wednesday): 6:30pm-8pm

This 2nd floor unit in North Arlington has been recently renovated with several updates including stainless steel appliances, maple cabinets, granite countertops, and fresh paint.

It is conveniently located one block from a bus-stop to NYC(45min to Port Authority by Bus, 1hr by Train, and 25 min by Car[no traffic]), as well as a mile away from Kearny Train Station and 1.5 miles from Lyndhurst Train Station.

There are many places to eat(Pizza, Boston Market, Dunkin Donuts, Bagel Deli, Indian, BBQ, Greek) and stores (7/11, CVS, Auto-Zone, TD Bank, Post-Office, Florist, Gas station) all within a three-minute walk. There are two parks, a library, elementary school and High-School only a 5-minute walk away. There are On-Ramps to Route 21, 17, 3, within 3 miles and 280, 95, and the Garden State Parkway are close-by as well.

North Arlington is ranked as the #1 town to raise a family by TIME magazine and in the Top 10 best towns in America from Money Magazine.

Apply Online: https://home.cozy.co/apply/275643

Requirements & Details:

- -Total Household Gross Income must be 2.5X Rent Amount

- -No Large Dogs, Only Well Trained Pets on a Case by Case Basis

- -Every Adult(18+) must have credit check and background check before final acceptance as tenants

- -Average Credit Score of Adults must be 620 or greater

- -No Criminals

- -No Smokers

- -Utilities are paid by Tenant

- -Coin-operated Laundry in Basement

- -Street Parking Only

- -$2000 Security Deposit

- -No Realtor Fee

1/12/18 (Day 278) Created Promotional materials

1/13/18 (Day 279) First Open House

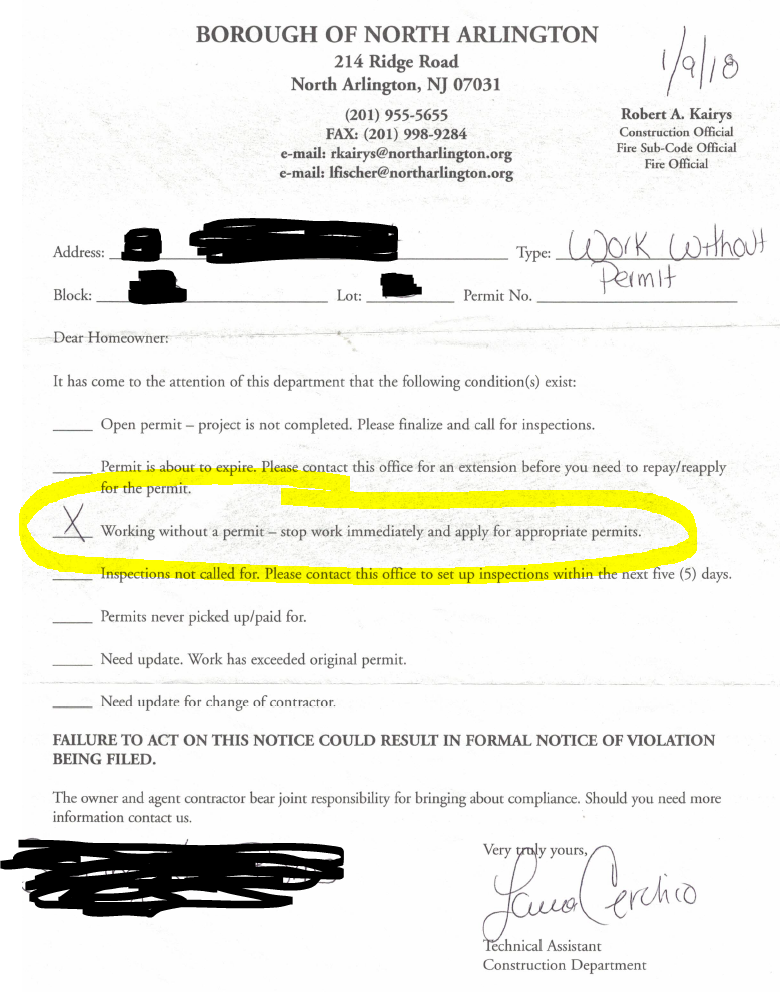

1/14/18 (Day 280) letter from town saying cease and desist

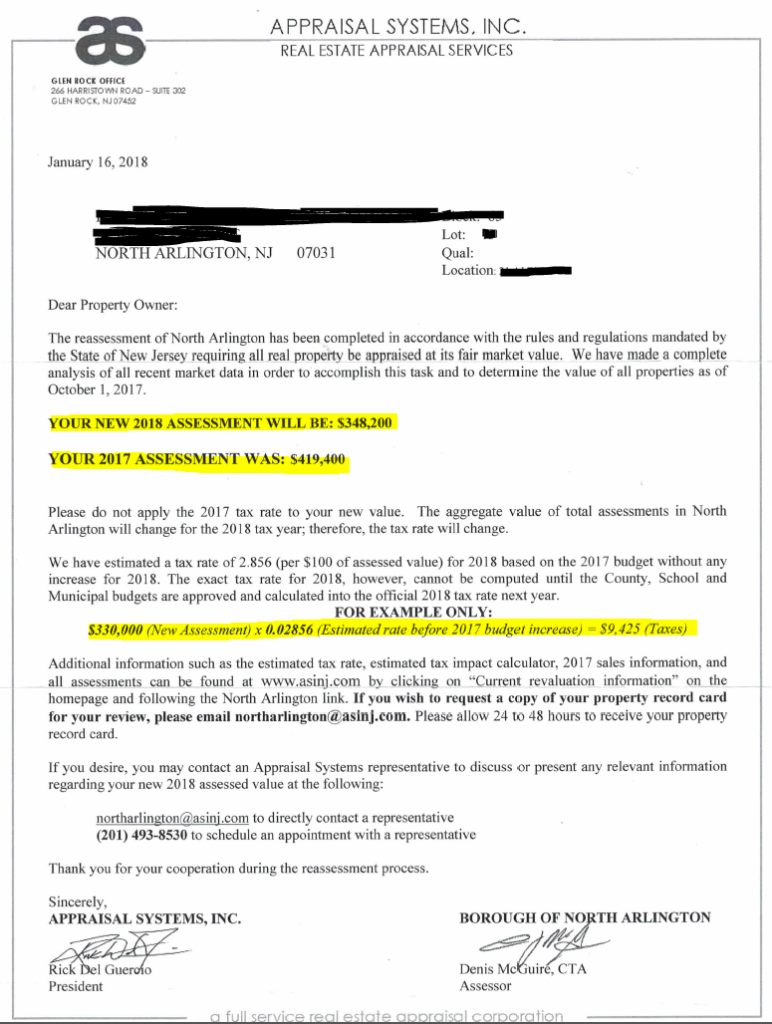

1/19/18 (Day 285) New Tax Appraisal, $3k in savings!

1/20/18 (Day 286) Trumps New Tax Plan – Rental Real Estate Property Tax Loophole

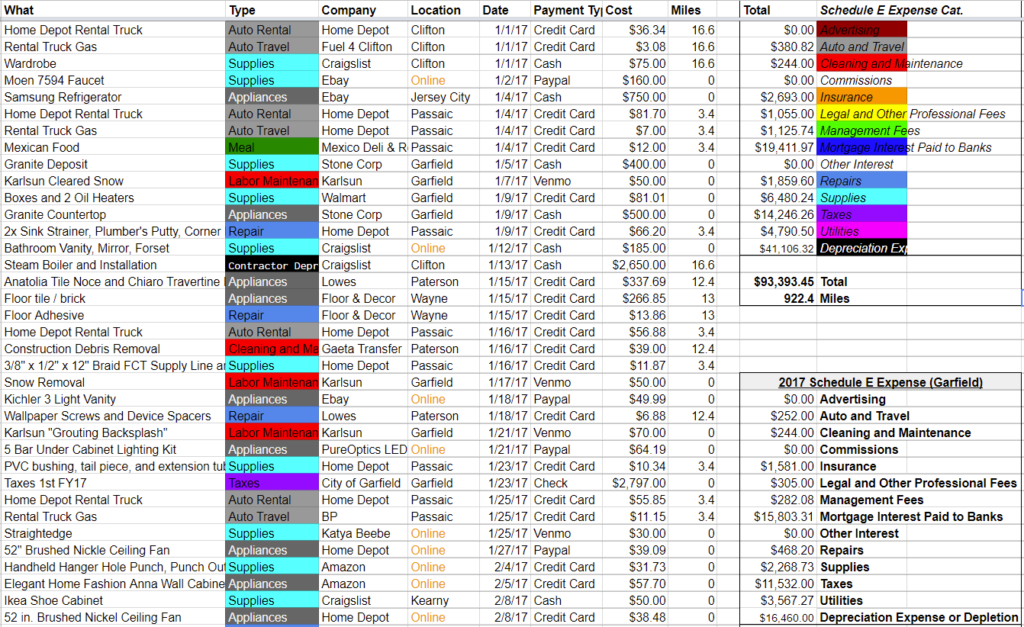

For those Buy & Hold Rental Real Estate Investors who have been concerned with the 2018 Tax Law that put a cap on personal property tax deductions to $10,000. There is no reason to fear.

If you are house hacking: Property taxes on the portion of the property that you occupy are reported on Schedule A and are subject to the new limitation($10k).

Property taxes on the portion of the property that your tenants occupy are reported on Schedule E and are not subject to the new limitation.

We househack(owner-occupy) a 4-family home. That costs $12,000 in taxes. We also have a 3 fam with $14,000 in taxes.

So I would put $12k/4= $3,000 deduction on my schedule A for my personal portion of the quadplex.

Then the remaining $9,000 + $14,000 = $23,000 in schedule E.

And since the $10k combined cap on property tax deduction + state income tax(For me last year ~$3k) is only limited to schedule A (personal property tax deductions). I will not be losing out on any deductions. Hope you all are in a similar boat.

2017 Tax Reform Bill: http://docs.house.gov/billsthisweek/20171218/CRPT-115HRPT-466.pdf

2018 Tax Cuts and Jobs Act: https://www.congress.gov/bill/115th-congress/house-bill/1

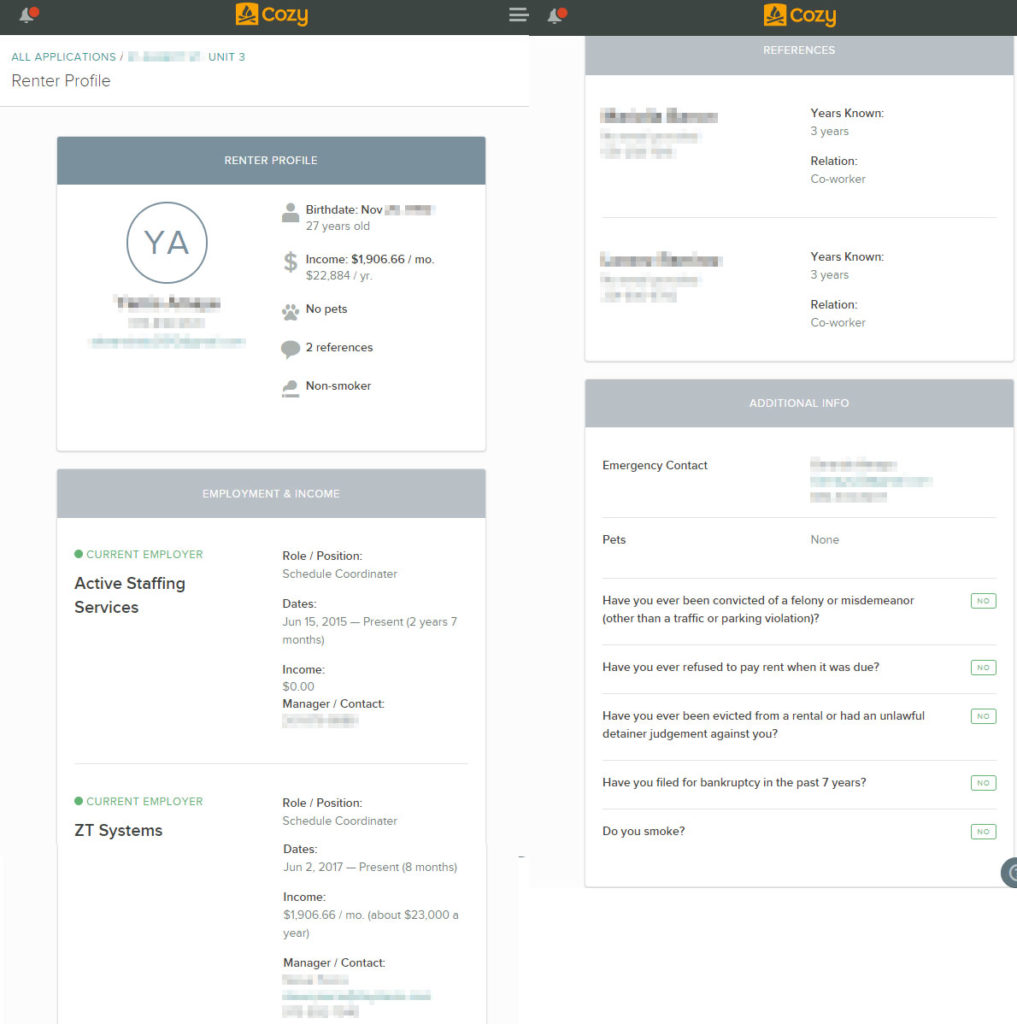

1/21/18 (Day 287) picked a tenant for unit 2 and how COZY.CO works

As you can see it truly is a one-stop shop, and once you’ve accepted your tenants, they can pay the rent from their bank account(Free) or Credit Card(Fee) right to your bank account through Cozy.co as well.

1/22/18 (Day 288) relisted unit 3

We had received a lot of applications, but the majority did not meet our credit score requirements, the ones who did that we contacted had already moved onto other places, so we decided to relist the unit and hold another weekend of open houses.

1/23/18 (Day 289) Painted garbage cans

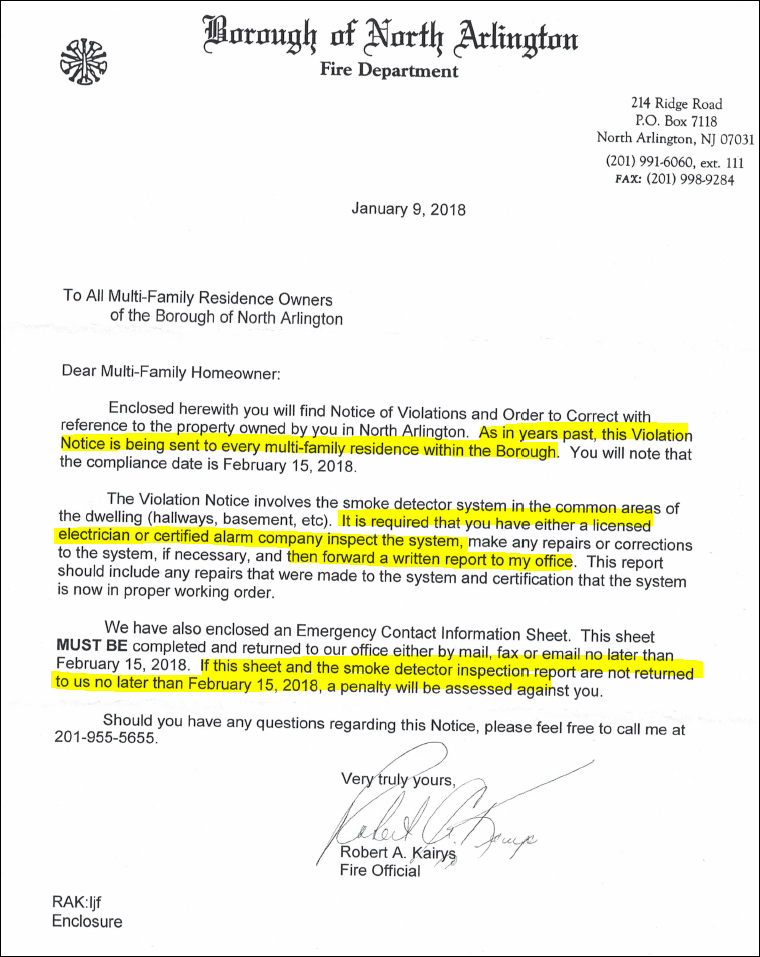

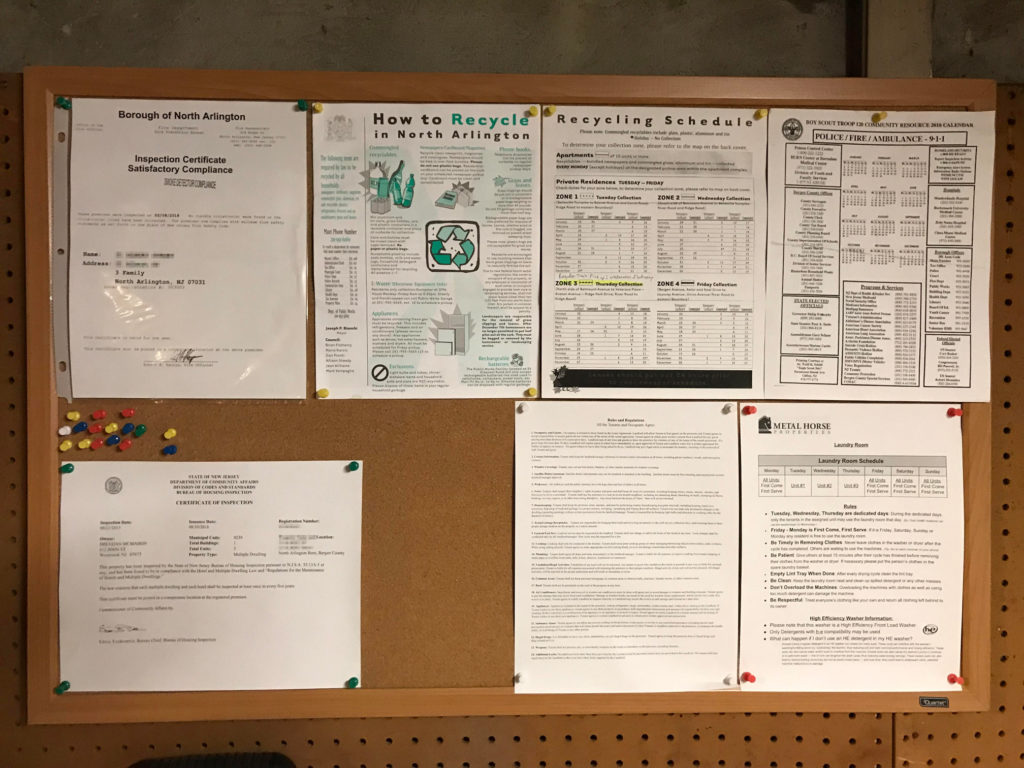

2/6/18 (Day 303) Fire Inspection for Multiple-Housing Dwelling

We received the below notice in the mail.

So we were forced to hire an electrician to check out system, ended up charging us a pretty penny, was like $200. But they sent in a report to the town and we got our satisfaction document signed.

2/11/18 (Day 308) Unit #3 Tenants Picked out.

2/28/18 (Day 325) Laundry Room Set-up

3/1/18 (Day 326) Fully Occupied! And it feels so Good!

I also emailed them, Truth In Renting (NJ Mandated), as well as Lead Disclosure Form & Information (Federally Mandated), and Town Garbage Schedule, and even though its already on the lease. A copy of the Rules & Regulations for the property.

3/2/18 (Day 327) First Problem Tenant Call…

4/6/18 (Day 363) Laundry Complete – LOCKERS!

Conclusion and Goodies

14 thoughts on “How to Buy a Triplex: A Step by Step Guide to House-Hacking an Investment Property in the NYC area”

Sunny,

I’ve tried reaching your via your email but have not received a response yet. Having a problem with password as I received a notification of a recent topic: Personal Finance 101… but I could not sign in.

If you can please allow me to reset my password. Thank you!

Hey Brad, I didn’t see your email, please send me any questions to sunny@FamVestor.com . regarding the notification for the new post, that was sent prematurely in error, although you will be excited to note, that post will be published today.

Thanks for being a subscriber.

Hi Sunny. Great job documenting the step by step and congrats on the acquisition!

How quickly and thoroughly did the town answer your OPRA request?

P.

They gave us a reply the next day on the 11th. Thye were thorough, signed letter on city letterhead saying it was a three-family, no liens. Info that sewer was included in taxes, and where to find water bill. As well as the closed permit on the decommissioned oil tank, they also gave us the tax history of the property.

I think its worth doing for every property you buy.

Wow, this is exactly what I have been looking for in biggerpockets, YouTube videos, and podcasts. Great post! This is my first time house hacking, I have a triplex under contract getting ready to close but I just have so many questions about inheriting tenants but this made it easier. Thanks for the post and step by step process. Hope you keep adding good cashflowing properties to your portfolio. Greetings from south florida!!

Thanks for the comment. You are exactly the kind of person this is supposed to help. Hopefully most of this translates to Florida.

“I get an automated email from IFTTT.com every time a post in the North Jersey Craigslist under the Real Estate for sale by owner section has the word “Family”.”

Huge tip! I’ve been trying to figure out how to filter for these properties in searches, this is such a simple solution. Thanks.

One of the best REI posts I have ever read ! Hows the house performing since last year ? Did you get an appraisal eventually ?

Yes we got it appraised about 4 months ago. It appraised at $525,000. $175,000 over what we bought it for. We established a $120k HELOC and just closed on another 4-fam using that money.

That’s awesome Sunny! Looking forward to another awesome blog report!

Hi Sunny, as always I am so grateful of the detailed information you provide in you blog. I had followed your instructions on using IFTTT.com to received Craigslist notifications, but for some reason I no longer receive them, can you recommend another affordable or free method that’s been helpful to you? Also, will you be blogging on your most recent acquisition of the 4 family? Thanks again!

Brad, I’m pretty sure Craigslist build in saved email searches now. Just look in the options. Yes I think I will blog about it once I get the time.

Hi! I just wanted to ask… you say that your financing requires you to occupy one of the units but it seems like you didnt immediately do that. It seems like you rented out the other units first. Is that allowed? What type of loan are you using? Conventional or fha? Do you have to pay PMI during the time you havent occupied the home yet?

We have always used conventional financing, usually try to put 10% down. For our first 3 house we found lenders who didn’t charge PMI (Trustco Bank, Roselle Bank) in my area.

So, for one thing, its not like Banks have agents who come in and check on you to make sure you are living in the home. We had to do a major renovation to the unit we were occupying, so that took time to move in, but all the while I was paying utilities under my name for that unit, and it was mine, I wasn’t renting it to anyone else. Most banks expect you to occupy for at least 6 months to 1 year. So after we did the renovations we moved in.